PayFi: The DeFi Settlement Infrastructure Connecting the Crypto World with Real-World Payments

I. Introduction: The Next Frontier of DeFi Payments

Over the past five years, stablecoins have steadily been serving as a key bridge between crypto assets and traditional finance. From cross-border payments to on-chain trading, asset custody to value preservation, stablecoins are redefining the concept of “money” in the digital era. In DeFi, stablecoins act not only as essential liquidity sources but also play a key role in ongoing experimentation with on-chain payments. However, extending crypto’s utility to real-world payments still faces several significant challenges:

- Fragmented payment infrastructure: Users and merchants operate across different chains, wallets, and stablecoins, leading to poor interoperability.

- High costs: On-chain transactions are often constrained by limited scalability and volatile gas fees.

- Lack of unified liquidation settlement: Cross-chain fund movement typically depends on centralized exchanges or bridges, which may raise trust concerns.

- Compliance complexity: Executing payments across jurisdictions involves navigating complex AML and KYC requirements.

Traditional Web2 payment systems benefit from unified liquidation networks, robust compliance structures, and tight integrations at the merchant level. While Web3 lacks this level of coordination, making it difficult for DeFi payment protocols to bridge the “last mile.”

PayFi was created to close this gap. Built around stablecoins, it introduces a modular payment infrastructure focused on liquidation, cross-chain routing, and compliance, combining the flexibility of DeFi with the efficiency of Web2 payment systems to provide a new foundation for global payments.

II. What is PayFi?

1. Protocol Definition

PayFi is an on-chain settlement and payment layer that connects stablecoin issuers, cross-chain liquidity providers, DeFi protocols, and merchants through standardized modules and compliance-ready interfaces.

PayFi is more than a wallet or a payment DApp. It is designed to be a comprehensive settlement infrastructure, aiming to become the “SWIFT + Visa” of blockchain space.

2. PayFi’s Core Goals

- Unify fragmented payment routes across chains.

- Reduce payment costs and improve liquidation efficiency.

- Provide compliance frameworks to support global regulation.

- Support multi-chain, multi-asset payments for both users and merchants.

- Establish standardized liquidation logic as the foundation for DeFi protocol settlements.

3. Key Roles

These roles operate within a modular framework to form a flexible and composable open settlement network.

III. PayFi’s Technical Architecture and Core Mechanism

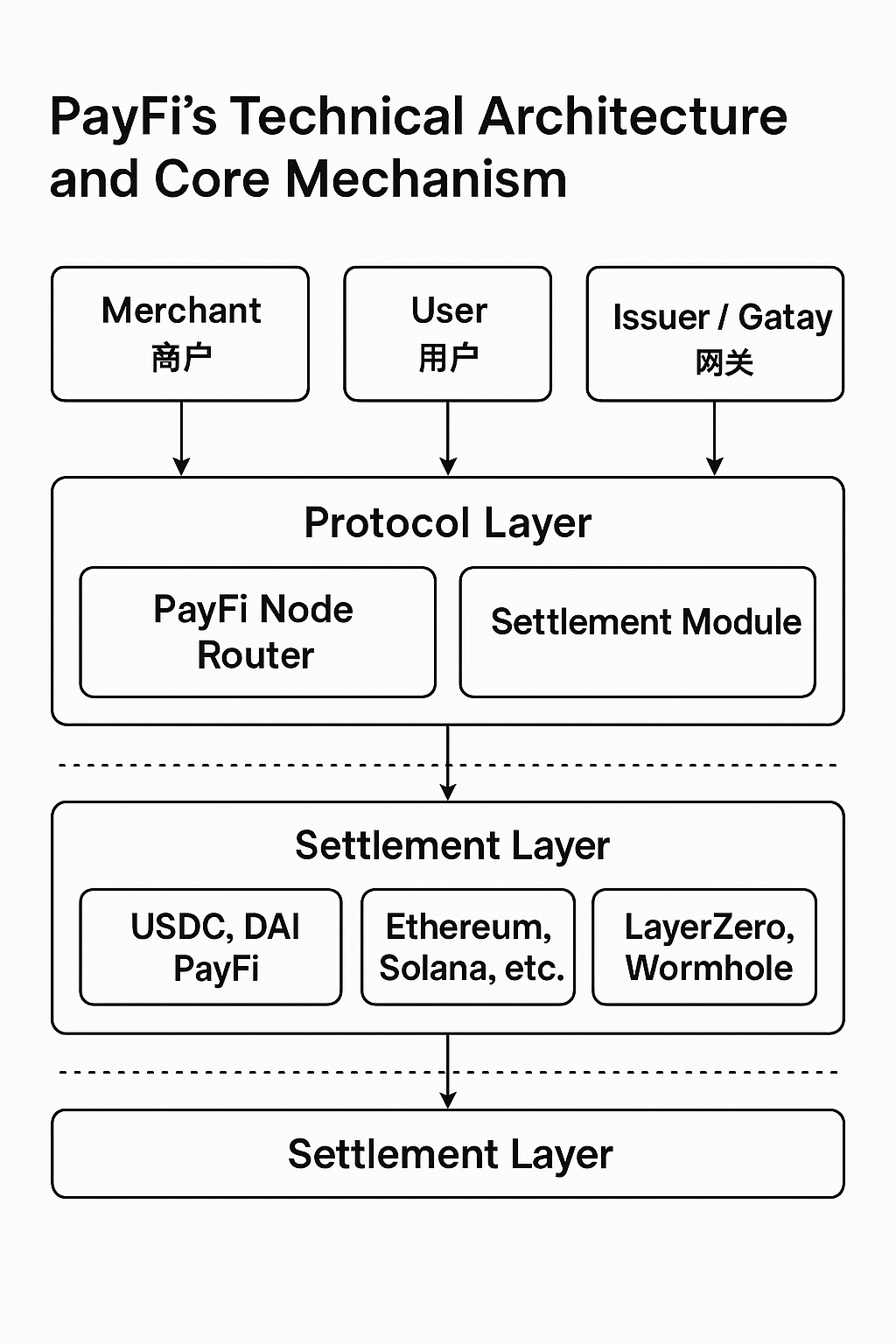

PayFi is built with a modular structure that supports cross-chain compatibility and compliance adaptability. It caters to user demands for smooth payments while addressing merchant needs for reliable clearing, liquidity access, and regulatory transparency. The system consists of three layers: Application Layer, Protocol Layer, and Settlement Layer.

1. Architecture Overview

The overall system is structured into three layers:

- Application Layer: Interfaces for wallets, merchant tools, on/off-ramps, and other user- or enterprise-facing platforms.

- Protocol Layer: Includes the payment router, liquidation engine, and compliance modules.

- Settlement Layer: Connects to base infrastructure like public chain assets, stablecoin issuers, and bridge networks.

This layered design supports flexible deployment across different chains and business contexts.

2. Three Core Modules

a. PayFi Router: Cross-chain Routing & Liquidity Aggregation

Acts as the network’s “dispatcher,” which automatically determines the optimal payment path across chains. Its core logic includes:

- Supports cross-chain conversions, such as USDC on Optimism → USDT on Solana.

- Aggregates state and price data from multiple bridge protocols to enable dynamic route evaluation.

- Prioritizes paths based on liquidity depth, estimated slippage, and execution costs.

The Router functions much like a flight scheduling system, enabling efficient and automated value transfers across assets and blockchains.

b. Settlement Module: Efficient On-chain Liquidation Engine

Once payments are initiated, this module handles final liquidation and reconciliation to ensure accurate fund delivery.

- Batch clearing: Consolidates multiple small payments into fewer transactions to reduce costs.

- Zero-knowledge support: Enables privacy-preserving settlement workflows.

- Programmable strategies: Offers flexible models such as T+0, scheduled, or conditional liquidation.

This module is particularly well-suited for high-frequency micropayments, e-commerce settlements, and cost-sensitive operations.

c. Compliance Layer: Flexible Compliance Engine

To support global use, PayFi includes a modular compliance interface that supports:

- Identity verification for users and merchants (KYC/KYB).

- Blocklist/Allowlist screening for wallets and funds flow.

- Jurisdiction-specific regulatory adaptation.

This layer can integrate with on-chain reputation systems, third-party audit APIs, and off-chain AML/KYC providers to meet evolving compliance requirements.

3. Multi-Chain and Multi-Asset Compatibility

PayFi supports major chains and assets:

- Chains: Ethereum, Arbitrum, Optimism, Polygon, Solana, Sui, TON, Aptos;

- Stablecoins: USDC, USDT, DAI, EUROC, PYUSD, and native stablecoin PUSD;

- Native tokens: Supports direct payments using ETH, SOL, APT, etc.;

- Fiat ramps: Connects with fiat on/off ramps and bank accounts.

4. Collaboration with Cross-Chain Protocols

Built atop protocols like LayerZero, Wormhole, and Axelar:

- Uses these bridges for asset messaging;

- Constructs its own clearing logic without relying on centralized execution;

- Switches between bridges dynamically for optimal liquidity use.

This approach abstracts the bridge layer as backend infrastructure.

5. Unlocking Time Value in Payment Flows

PayFi enables temporary use of in-transit funds:

- Idle settlement funds can be deployed to DeFi protocols for yield;

- Cross-border payments can be completed within minutes;

- Payment actions generate on-chain credit data usable as collateral (e.g., receivables NFTs).

6. Example Use Case

Imagine you’re in Singapore using USDC on Solana to buy coffee from a German café that only accepts DAI on Arbitrum.

Without PayFi: You’d need to manually swap, bridge, and transfer—costly and complex.

With PayFi: The system auto-routes Solana → Ethereum → Arbitrum, performs swaps and settlement behind the scenes. The merchant instantly receives DAI with a single click from the user—fast, accurate, compliant.

4. Key Application Scenarios: Who Uses PayFi?

PayFi isn’t tailored to a single niche; it’s designed to solve foundational payment and clearing problems across a wide range of scenarios:

1. E-commerce Payments

- Use case: NFT marketplaces, digital goods, creator platforms;

- Experience: Users pay in any stablecoin on any chain, merchants receive preferred assets;

- Value: Seamless routing, fast confirmation, stable settlements.

2. Stablecoin Settlement for DeFi Protocols

- Use case: DEXs, yield aggregators, lending platforms;

- Usage: Protocols use PayFi for cross-chain conversion and reconciliation;

- Value: Reduced slippage, lower clearing costs, efficient liquidity migration.

3. Freelance & Remote Work Payments

- Use case: Global developer platforms, bounty systems;

- Usage: Employers distribute wages via PayFi, users choose their stablecoin/chain;

- Features: Multi-chain distribution, periodic payouts, real-time confirmation.

4. Offline Web3 Merchant Payments

- Use case: Crypto event booths, themed cafés, brand stores;

- Usage: Merchants integrate PayFi POS systems, users scan QR codes with any stablecoin;

- Benefit: Automatic FX settlement, no manual intervention.

5. Enterprise Billing and Financial Automation

- Use case: Cross-border SaaS, supply chains, API vendors;

- Usage: PayFi handles recurring payments, B2B reconciliations;

- Features: Batch payments, on-chain invoices, compliance reporting.

6. Application Scenario Overview

7. Summary

PayFi is chain-agnostic and can be embedded into any on-chain payment scenario. For users, it hides complex routing and conversions. For developers and merchants, it offers a standardized, composable clearing system. Ideally, users don’t even need to know what PayFi is—they just experience payments that are as smooth as in Web2.

5. Roadmap and Future Outlook

PayFi’s growth will be gradual, advancing in parallel with multi-chain ecosystems, stablecoin circulation, and evolving compliance norms. It’s currently in the protocol-building and early integration stage, with a future that spans tech iteration, ecosystem expansion, and open governance.

1. Current Phase: Protocol Launch and Initial Integrations

- Core deployment: Router, settlement engine, compliance modules;

- Multi-chain tests: Ethereum, Arbitrum, Optimism, Solana, etc.;

- Initial partnerships: E-commerce, freelance, content platforms;

- SDK/API: Public developer tools for easy integration;

- Audits & compliance: Security audits and regulatory framework development.

2. Mid-Term Plan: Feature and Ecosystem Expansion

Assets & Chains: Add support for PYUSD, GHO, LUSD, more chains like Base, zkSync, Scroll;

Bridge compatibility: Deepen integration with LayerZero, Wormhole, Axelar;

Native asset (PUSD): Internal stablecoin for settlements;

Ecosystem partnerships: With stablecoin issuers, Web3 wallets (e.g., Phantom, Rainbow), and POS/payment hardware.

PayFi Wallet Launch: Visual payment flow, historical tracking, reports, enterprise features.

3. Long-Term Vision: On-Chain Clearinghouse and Governance Network

Settlement Hub: Multi-chain → unified → redistributable asset clearing;

Liquidity aggregation: High-efficiency cross-chain value transfers;

Use case expansion: Receivables NFTs, cross-border payments, supply chain finance.

Governance: Launch \$PAY token for governance;

Incentives: Liquidity mining, user rewards via PayPoints;

Validator role: Community-verifiable path routing via oracles.

Real-world integration: Connect with fiat ramps and custodians, support ZK and ASP privacy compliance.

4. Summary

PayFi doesn’t aim to disrupt traditional finance overnight but instead gradually permeates every on-chain payment and settlement scenario through modular design. By linking assets, routes, and identities, PayFi could become the foundational payment network of the Web3 economy.