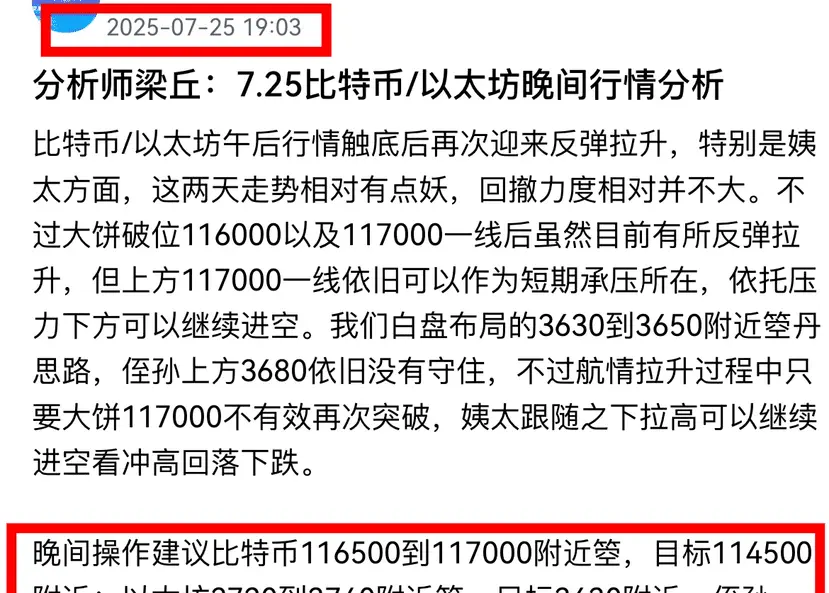

Recent trends in the crypto assets market have attracted attention. After Bitcoin broke the 120,000 mark, 123,000 and 125,000 became new resistance levels. In the short term, 132,800 seems difficult to reach, and it may have to wait until the interest rate cut cycle in September for a chance.

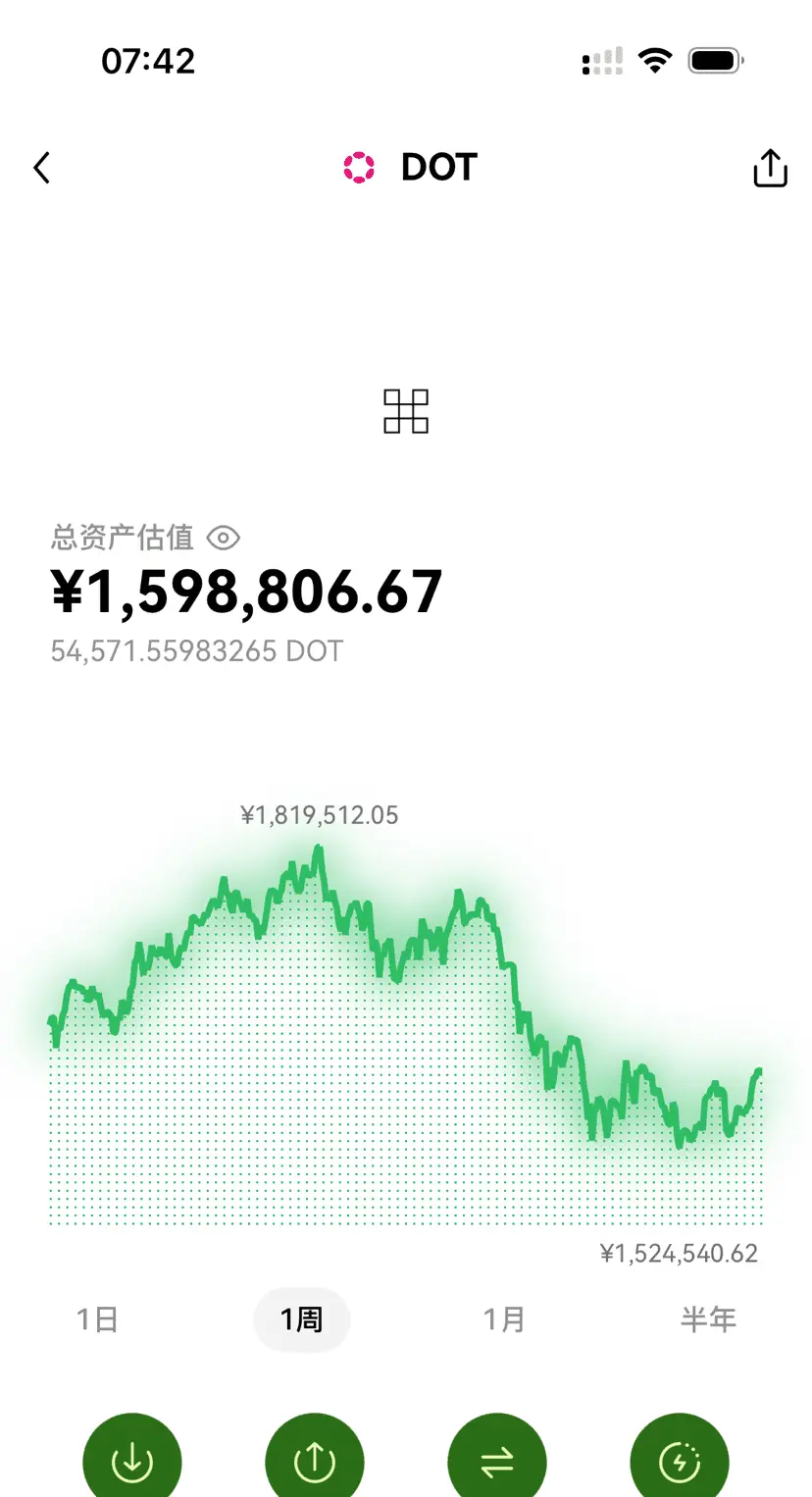

Currently, investors should focus on the performance of Ethereum, Solana, and Litecoin. After major tokens like Ethereum reach their previous highs, we will further assess the target price levels for Solana and Litecoin. For spot holders, maintaining patience is a wise choice.

In terms of altcoins, PENGU

View OriginalCurrently, investors should focus on the performance of Ethereum, Solana, and Litecoin. After major tokens like Ethereum reach their previous highs, we will further assess the target price levels for Solana and Litecoin. For spot holders, maintaining patience is a wise choice.

In terms of altcoins, PENGU