ZORA Soars 5x in 10 Days: Uncovering the Value of Content Tokens

The Initial Vision

When we first drafted this internal memo, ZORA had just launched, its token price was falling rapidly, and the project’s narrative was still taking shape.

But we weren’t chasing a meme coin. Instead, we were focused on a protocol that can iterate at high speed and—crucially—can monetize attention on-chain.

Over the past few years, ZORA has evolved from a straightforward minting platform into a protocol-based product built on its own L2 infrastructure, and later transformed into a consumer app that empowers creators to monetize directly on-chain.

Early on, it featured some clear standout traits:

·Rapid product iteration: supporting AI-generated content, integrated USDC payments, and a mobile-first user experience

·A unique creator token model with viral growth potential

·A transparent, measurable protocol revenue model

·A team with deep expertise in product and market design

ZORA’s on-chain mechanism is highly efficient:

·Creators mint content on the platform; fans support them by buying their tokens

·All liquidity is routed through the ZORA token

·Tokens are denominated in ZORA and traded on Uniswap v4

·Zora Labs collects a roughly 0.25% fee from each transaction

At its peak, ZORA’s annualized transaction volume was close to $5 billion, with estimated annual revenue of $6 million. While most trading didn’t happen on the official app, we see this as an entry opportunity, not a fundamental weakness.

Where Is Zora Now?

While the ZORA token price remains below its post-TGE high, the product itself has grown stronger.

Creator tokens are active and performing well. Anyone can mint their own creator token and link it to a content token. These tokens are priced using bonding curves and denominated in ZORA, with instant settlement.

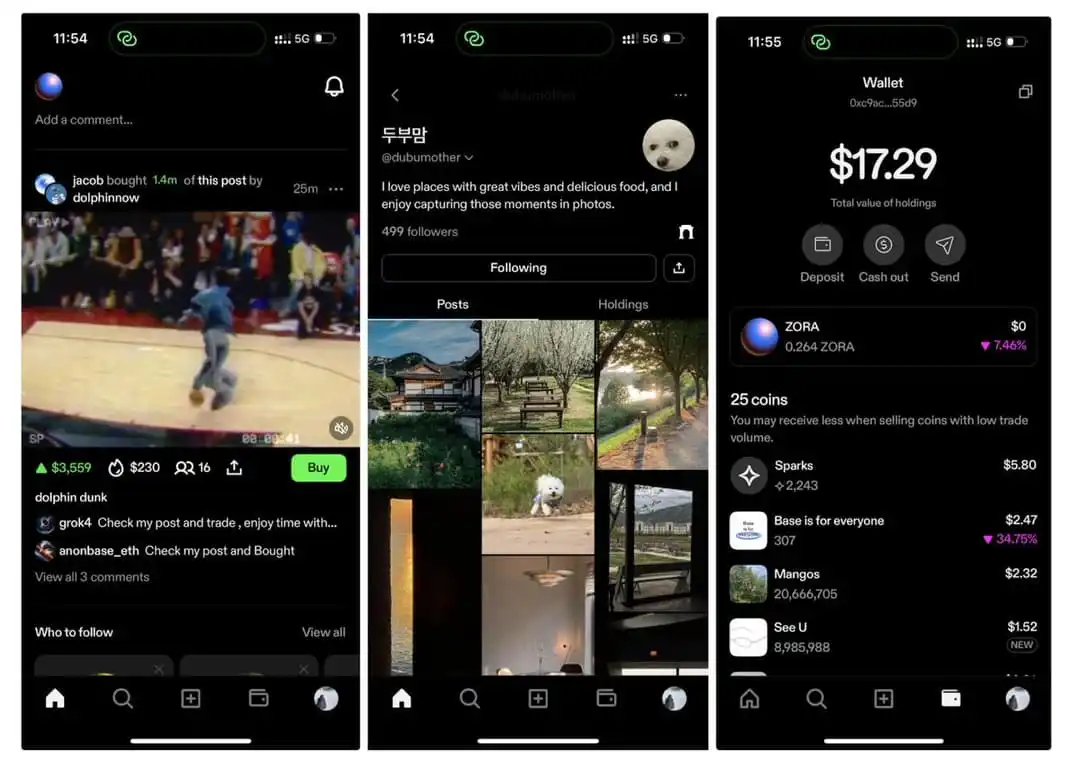

The overall user experience is like a TikTok feed with embedded market mechanics—attention can be instantly monetized and flows freely.

Content feed and product interface

User engagement is healthy:

·Creators who interact with more than five posts have a 30-day retention rate between 11–27% (a16z considers a 25% D30 an excellent benchmark for social products).

·Creator activity keeps rising: from three posts per creator in the first month to 10 per creator by month four.

The pricing-pair model has further accelerated engagement—a mechanism first pioneered by Virtuals.

Each token transaction involves:

·The creator

·The purchaser

·The Zora Labs team

·ZORA itself

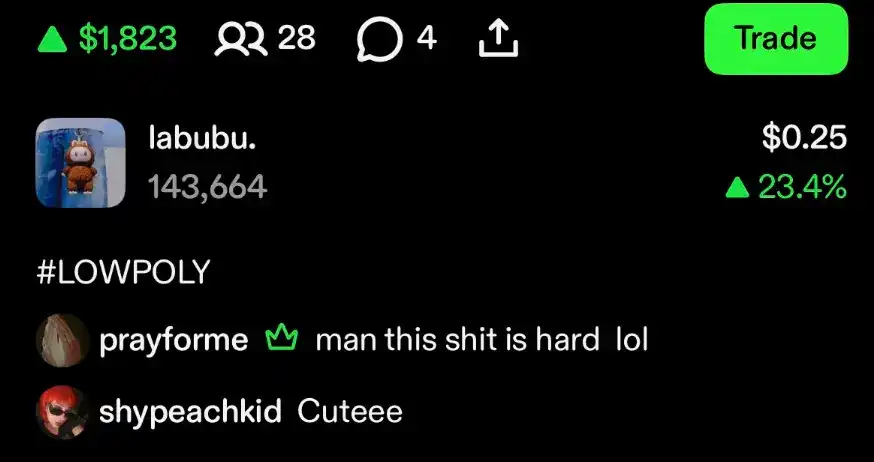

Referral invitations, top-holder-pinned comments, and post monetization features are steadily building a crypto-native attention economy.

This is a true consumer app with real protocol revenue.

Zora is steadily overcoming its distribution challenge.

Now, Zora is deeply integrated with Base through an official app called TBD. This app uses a TikTok-style format and is built directly on Zora’s protocol foundation.

It’s no longer just a monetization channel—it is becoming a full-stack foundational platform. The team has distilled the ecosystem into six core pillars:

·Built-in sharing: User flows encourage sharing on external social media

·Creator incentive program: $1 million fund aimed at attracting mid-tier creators in music, fashion, lifestyle, and memes (typically under 10,000 TikTok followers and about 50–60,000 Instagram followers)

·User growth marketing: Paid promotions on platforms like TikTok

·Token incentive allocation: 20% of TGE allocation dedicated to a variety of incentive programs, including trading rewards and broader community incentives

·Events and media: Outreach through podcasts and events targeting crypto and creator communities

·Developer ecosystem: Teams such as Base and Noice are developing new features and strengthening the Zora protocol ecosystem

Currently, if you search “Zora” on TikTok, you’ll find almost nothing. With even moderate effort, there remains significant potential for rapid social media growth.

On-Chain Metrics

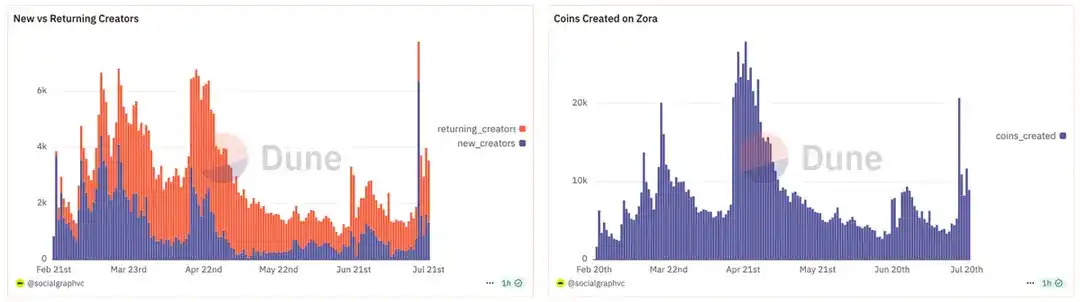

According to our Dune analytics, Zora’s fully diluted valuation is currently approximately $250–300 million, with peak annualized trading volume at $1.8 billion. The protocol currently collects a 1% trading fee, with about 0.25% directed to Zora Labs. During the peak, this brought annual protocol revenue close to $18 million.

As of July, Zora’s annualized trading volume is approximately $594 million, with only 4,000 to 7,000 daily active creators. Based on its product experience and economic model, we believe Zora could grow its creator base by 10–100x in the next 12 months.

See our Dune dashboard for more details: https://dune.com/socialgraphvc/dollarzora

Consider Zora Labs as R&D

In the crypto industry, there’s ongoing debate about whether the protocol or the team behind it reaps more real value.

While we don’t speak for Zora Labs, after many discussions with the team, we see it this way: the income Zora Labs earns essentially serves as R&D funding.

The 0.25% protocol fee per transaction that’s allocated to Labs isn’t just value extraction—it’s the fuel for:

·Relentlessly improving creator tools

·Building infrastructure for user growth

·Powering ecosystem experiments

·Optimizing overall experience across mobile and web

If Zora Labs can keep boosting user engagement, build a better monetization model, and grow protocol liquidity, these results will ultimately strengthen the long-term value of the ZORA token.

While Zora Labs represents an operating expense, it consistently delivers tangible results.

Could Advertising Become Zora’s Moat?

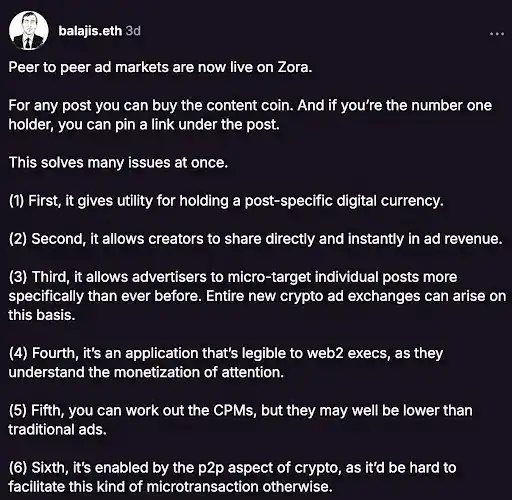

Advertising is one of Zora’s most important and uncertain challenges.

Brands have not yet actively participated in Zora’s content token economy, but the opportunity is emerging.

If Zora can leverage its token mechanics to build a native advertising system—enabling brands to sponsor posts, hold content tokens, or directly amplify creator influence—the ecosystem could evolve into a self-sustaining attention marketplace.

Top holders’ pinned comments

Zora creator Balaji’s perspective on advertising

Early prototypes are already emerging. For example, the top content token holder can pin their comment on a post—effectively an initial form of ad inventory. In time, this could expand into a fully native brand marketing channel for post promotion and partnership campaigns.

If Zora delivers on this vision, the result will be more than just profit-sharing with creators—brand capital will flow directly into the token system, bypassing traditional banners and pop-ups entirely.

We believe they’ll ultimately achieve this.

Team Background

Zora’s team is a high-caliber group of Coinbase alumni who consistently drive innovation in content monetization, aiming to blend crypto-native and Web2 user experiences in novel ways.

They’ve moved the industry forward with innovations like bonding curve-based pricing, content-driven tokenization, and referral incentive mechanisms. Zora is open to public experimentation and fast iteration—qualities we especially prize in teams pioneering new social, creator economy, and monetization models. Core team members include:

·Jacob Horne (Co-founder & CEO): Former Coinbase product manager for USDC and Coinbase Ventures, with a strong focus on Ethereum and DeFi. He’s well-versed in crypto market design, NFTs, and the creator economy, and has led Zora since 2019—also with early involvement in crypto fashion.

·Dee Goens (Co-founder): Previously on Coinbase’s marketing team and a key player in the NFT surge. Built Zora’s early community strategy and partnerships, with a long-term commitment to empowering underrepresented creators.

·Tyson Battistella (Co-founder & CTO): Leads technology at Zora. Previously a Coinbase smart contract architect, he built core Zora protocol infrastructure, including minting tools and L2 solutions.

Tokenomics

Zora’s token officially launched (TGE) on April 23, 2025, with a total supply of 10 billion and a peak valuation of $600 million, backed by firms like Haun Ventures.

Token allocation breakdown:

·Strategic investors: 26.1% (2.61 billion)

·Team: 18.9% (1.89 billion)

·Community incentives: 20% (2.0 billion)

·Treasury: 20% (2.0 billion)

·Airdrop: 10% (1.0 billion)

·Liquidity: 5% (0.5 billion)

Vesting schedule:

·Airdrop & liquidity (15%): fully vested at TGE

·Community incentives (20%): fully vested at TGE, used for ecosystem growth and rewards

·Team & strategic investors (45%): 6-month cliff post-TGE, linear vesting starting October 23, 2025, over 36 months

·Treasury (20%): also linear vesting from October 23, over 48 months

Conclusion

While ZORA’s price hasn’t rebounded yet, its on-chain activity, content ecosystem integration, creator retention, and protocol revenue have all shown structural improvement.

Zora’s contribution is more than token launches or hype—it provides a sustainable monetization path for the entire attention economy through its content minting model.

Among crypto consumer applications, we continue to see Zora as one of the most promising long-term opportunities.

Disclaimer:

- This article is reprinted from [BLOCKBEATS]. Copyright belongs to the original author [Social Graph Ventures]. For concerns regarding reprinting, please contact the Gate Learn Team for prompt handling according to relevant procedures.

- Disclaimer: The opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn Team. Without specific mention of Gate, reproduction, redistribution, or plagiarism of translated content is prohibited.