The Iron Curtain Falls: Stablecoin Alliances Fight for 2025

Yiwu and Hangzhou: Where Not Only Bottled Water, but Stablecoins, Flow Freely

Follow @YBSBarker to see stablecoins move as seamlessly as water.

From underground economies across Asia, Africa, and Latin America to the Indian diaspora along the Arabian Sea, a new iron curtain now stretches across the developing world.

Behind this curtain are the barriers constructed by global banks and fintech powerhouses—Bank of America, JPMorgan (big and small), non-bank financial institutions, Wall Street, K Street, China’s “Big Four” state-owned lenders, and the power centers of Washington and Silicon Valley.

These iconic strongholds and their capital flows all operate squarely within the realm of traditional finance (TradFi). Yet, in one way or another, they have all come under the influence of stablecoins—especially USDT, which, together with Justin Sun, increasingly controls these financial arteries.

Tether’s Defocused Strategy

Messari recently published its 2025 stablecoin report. Beyond the wave of logos and sponsor placements, it marks the opening salvo in the stablecoin wars. Whether the segment is payment stablecoins, cross-border settlements, or C2C remittances, nearly all roads lead to the USDT–Tron alliance, with only USDC and the Circle Payment Network (CPN) barely keeping pace.

Yet USDT’s stablecoin kingdom is far from unassailable. Justin Sun’s Tron has established a near-monopoly, while Tether itself is spreading its bets too widely. USDC’s “revenue share” with Coinbase, combined with Binance’s adoption, has eaten into the market. Meanwhile, Ethena’s “vote-buying” model has gained traction by tying up with centralized exchanges (CEXs) to capture arbitrage and yield.

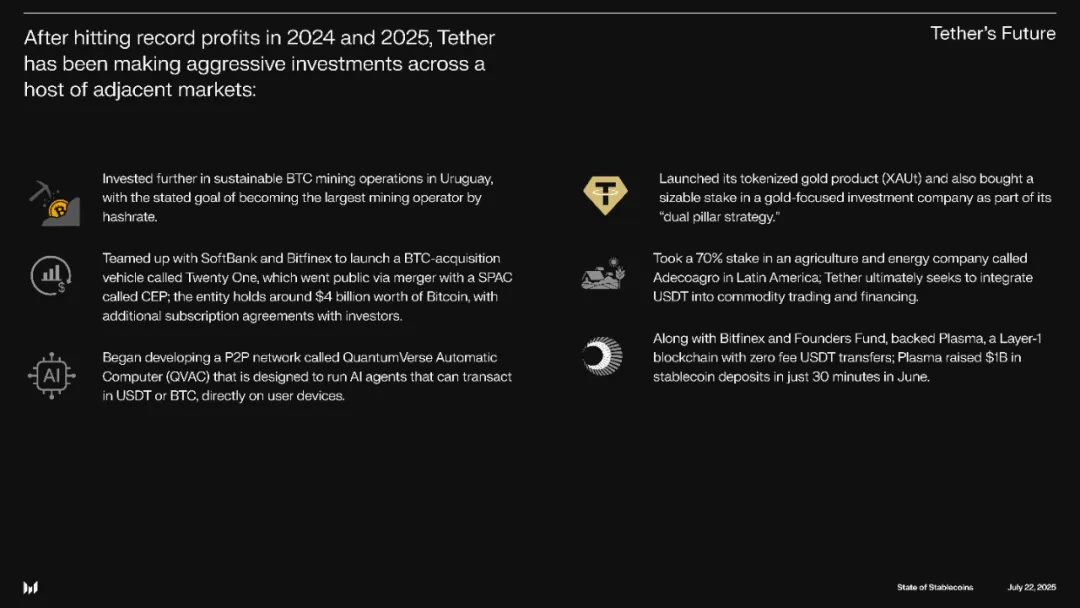

Image: Tether’s diversification into non-stablecoin businesses

Source: @MessariCrypto

Gold-backed dollar —–> Petrodollar —–> Stablecoin dollar

After posting a net profit of $14 billion in 2024—surpassing BlackRock—stablecoins have finally shaken off the lingering doubts from the UST collapse and returned to the global financial spotlight. This development is the direct catalyst for the GENIUS Act, which focuses specifically on stablecoin regulation. The motivation isn’t just profitability; stablecoins have now eclipsed even established national entities such as Germany to emerge as key buyers of U.S. Treasuries.

The synergy between the U.S. dollar and Treasuries, outwardly framed as the “petrodollar,” is underpinned by American military dominance. Yet, stablecoins are transforming the sales model for short-term Treasuries, positioning themselves not just as a supplement to the dollar, but as a new form of the dollar itself.

Tether, however, isn’t focused on direct competition or compromise. Its ambitions instead extend to Bitcoin mining, developing password managers, deploying solar-powered nodes across Africa, entering institutional settlements via Plasma—and, like Twitter’s co-founder Jack Dorsey, building out the Bitcoin ecosystem on a grand scale.

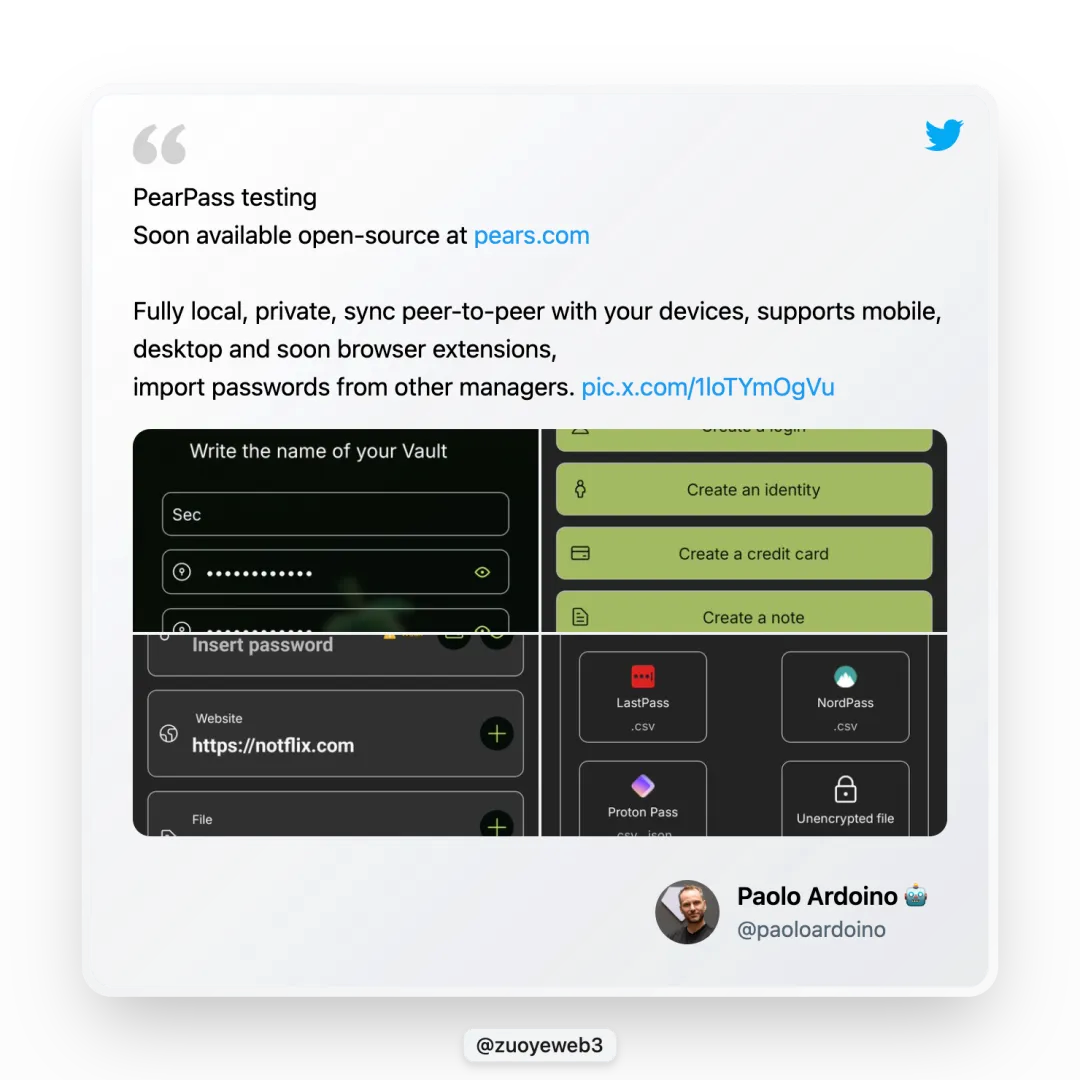

Image: Tether launches the Pears password manager

Source: @paoloardoino

On June 29, Tether CEO Paolo Ardoino announced the open-source, free password manager Pears. While this doesn’t directly strengthen Tether’s core business, it reflects Tether’s commitment to technical excellence and original intent—they pursue these projects out of genuine passion rather than profit.

When it comes to Bitcoin, Tether is truly “different.”

Of course, for Tether, such diversification is the hallmark of major players. But among its broad investments, the real focus is on expanding the Bitcoin ecosystem and payment networks: the former shows its long-term conviction in Bitcoin, the latter is a tactical move to diversify away from Justin Sun’s influence.

On that note, relations between Justin Sun and Tether have grown increasingly tenuous. Sun has attempted to loosen his dependence on USDT with TUSD, USDD, and FDUSD, while Tether continues to Court new networks. Still, they remain inextricably linked, their futures tightly bound. Bitcoin remains Tether’s true passion—Justin Sun is little more than a side story, and separation appears impossible.

Tether’s investment and infrastructure support for Bitcoin has never wavered. The earliest USDT was launched on Bitcoin’s Omni chain, though that ultimately didn’t last. More recently, Tether deployed on Bitcoin sidechain Rootstock, and its Plasma initiative treats both BTC and USDT as first-class assets.

This enthusiasm transcends mere claims to legitimacy—it looks and feels like genuine devotion. Personally, I don’t see a bright future for Omni or Rootstock. Bitcoin, as the world’s digital gold, has an enduring role; Plasma is promising, but faces fierce competition, far from the lonely dominance enjoyed by USDT in its early payment days.

Struggles for Dominance: The Scar and Hyena Alliance

History shows that great empires often fall from internal strife—and USDT’s alliance is anything but stable.

Who will inherit Tether’s mantle—Plasma or Stablechain? On the surface, Plasma appears favored, but the relationship between USDT and USDT0 remains ambiguous. USDT0 acts like a parallel branch cultivated by Tether independently of Plasma, making the succession contest particularly intriguing.

Of course, these are internal ecosystem conflicts. Externally, USDC is leading the way toward regulatory compliance. The GENIUS Act provides clear rules, Circle has already used CCTP for on-chain interoperability, and adopted ISO 20022 to enter SWIFT—offering full integration between on-chain and off-chain systems.

If Circle represents “Scar,” USDG is the “hyena alliance.” As issuer of former BUSD, Paxos now backs USDG, countering CPN, Stablechain, and Plasma with its Global Dollar Network (GDN). This ecosystem brings together leading exchanges like Kraken, Bullish (evolved from EOS, holding 164,000 BTC), Bitcoin giant Galaxy, and the red-hot broker Robinhood.

Image: GDN member network

Source: @global_dollar

Currently, stablecoin alliances are divided among four primary groups:

- • USDT: Binance–Tron–Tether–Bitfinex

- • USDC: Coinbase–Circle–Binance

- • USDG: Paxos–Bullish–Galaxy Digital–Kraken–Robinhood

- • USDe: Ethena–Arthur Hayes–Bybit

Together, they cover the full scope of payments, settlements, and valuation. But their internal mechanics are far from transparent: most rely on “vote-buying” systems—first popularized in the Curve War by Convex and now dominant in the Pendle War LST/LRT era via Penpie and Equilibria.

These protocols don’t simply lobby stakeholders; instead, they design incentive mechanisms to pull more capital under their umbrella, winning scale advantages and capturing greater Curve or Pendle rewards to share with their users.

Lido’s model is even more straightforward: retail investors can participate without running their own nodes—just pay a fee to Lido. In effect, Lido has become Ethereum’s biggest “vote-buying” platform.

USDC employs a similar playbook, allocating 60% of revenues to Coinbase and Binance to solidify its rank as a close second to USDT—profitable regardless of margin, but with the extra benefit of a resilient partnership. When Silicon Valley Bank collapsed and USDC lost its peg (falling to $0.87), Coinbase did not walk away.

Ethena’s USDe fits this mold as well. Virtually every major CEX is an investor—Binance (YZi Labs), OKX, Bybit, Deribit, Bybit (Mirana), Gemini, and MEXC. Ethena opens its doors to all centralized exchanges, and this is its strategic genius: CEXs receive ENA tokens in exchange for enabling USDe’s hedging and price stability.

Cracks are now appearing in the USDT alliance. In the race for institutional settlement, USDT lags behind USDC’s institutional adoption, and even Ethena has partnered with BlackRock to launch USDtb and with Securitize for the Converge institutional chain.

Following suit, USDG is promising ecosystem participants 97% of issuance revenue—willing to lose money for market share in hopes of overtaking USDT and USDC as the third force. Much like China’s food delivery wars, only time will tell who survives the stablecoin wars, and who pays the ultimate price.

Conclusion

The stablecoin wars, now in their eleventh year since USDT’s 2014 debut, have been long and eventful. Offshore RMB stablecoins emerged not long after USDT and have grown to similar scale. For example, Huobi once directly supported RMB-denominated trades, just as Kraken now offers USD pricing.

Let’s hope this time the market avoids another “winner-takes-all” outcome—and that Bitcoin’s hash rate pricing power isn’t handed over to others again.

After all, water can return after it flows away, but money that leaves may never come back.

Disclaimer:

- This article was republished from [Zuoye Waimoshan], and all rights reserved by the original author [Zuoye Waimoshan]. For reprint requests, please contact the Gate Learn Team. The team will respond promptly in accordance with the established process.

- Disclaimer: The views and opinions expressed in this article are those of the author alone and do not constitute investment advice.

- Other language versions are translated by the Gate Learn Team. Unless specifically referencing Gate, translated articles may not be copied or distributed without permission.