No more being squeezed when trading on SOL? Understanding Jito’s newly launched BAM

On July 21, Jito Labs introduced BAM (Block Assembly Marketplace) to address persistent challenges in blockchain ecosystems, such as unfair transaction ordering and MEV (Maximum Extractable Value), and to usher in a new paradigm for transaction processing on Solana. BAM’s objective is to create a more transparent and controllable transaction execution flow for Solana that maintains high performance while adding privacy protection, verifiable ordering, and application-level programmability, resulting in an efficient and fair on-chain execution marketplace.

This article examines BAM’s technical framework, use cases, impact on the ecosystem, and development roadmap to help readers understand the importance of this foundational infrastructure.

Background: The MEV Challenge and Block Construction Reform

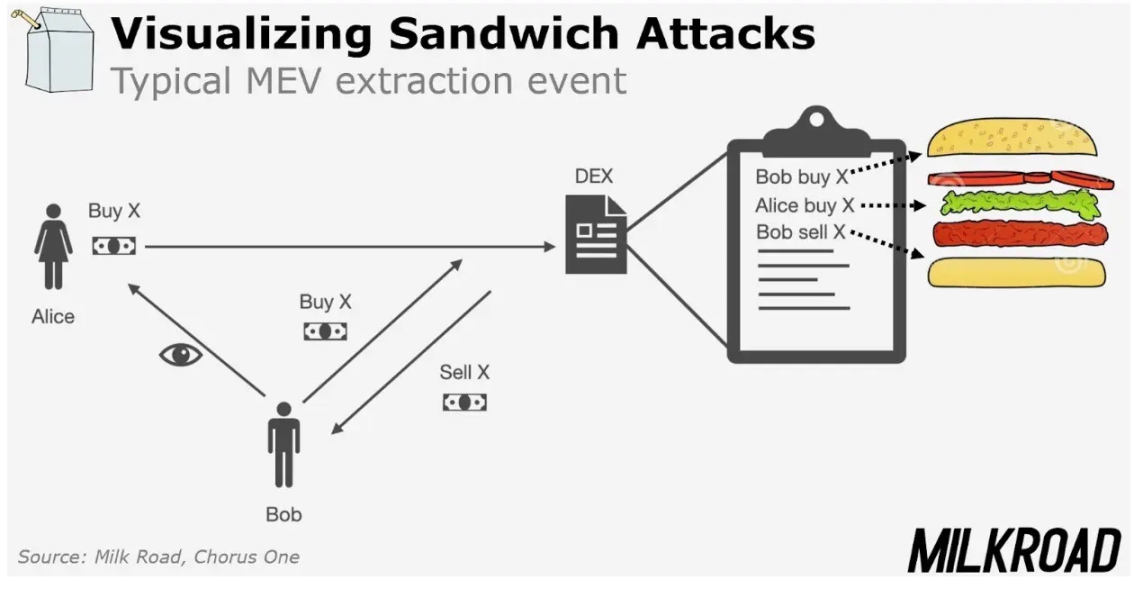

Traditionally, blockchains assign transaction ordering to block producers (in Solana’s case, Leader nodes). This enables certain nodes to profit by prioritizing, reordering, or sandwiching transactions (known as “front-running” or “preemptive trading”)—behavior collectively referred to as MEV. Although it’s called “value extraction,” this approach generally harms users and dApps in practice, eroding fairness and degrading the user experience.

This issue is particularly pronounced for blockchains using central limit order books (CLOBs) for trading, since order execution directly affects trading outcomes. Without a transparent and controllable ordering mechanism, not only are users disadvantaged, but protocol revenue can also suffer.

Illustration: User facing a “sandwich attack”

The Ethereum ecosystem has introduced Proposer-Builder Separation (PBS) to establish block construction marketplaces, separating ordering power from block proposers to help mitigate MEV. Performance-driven Solana, by contrast, is pursuing a more aggressive and native approach through BAM—a fully integrated ordering marketplace structure spanning from hardware to underlying protocol.

Architecture and Plugin Mechanism

The BAM system is built on several core components:

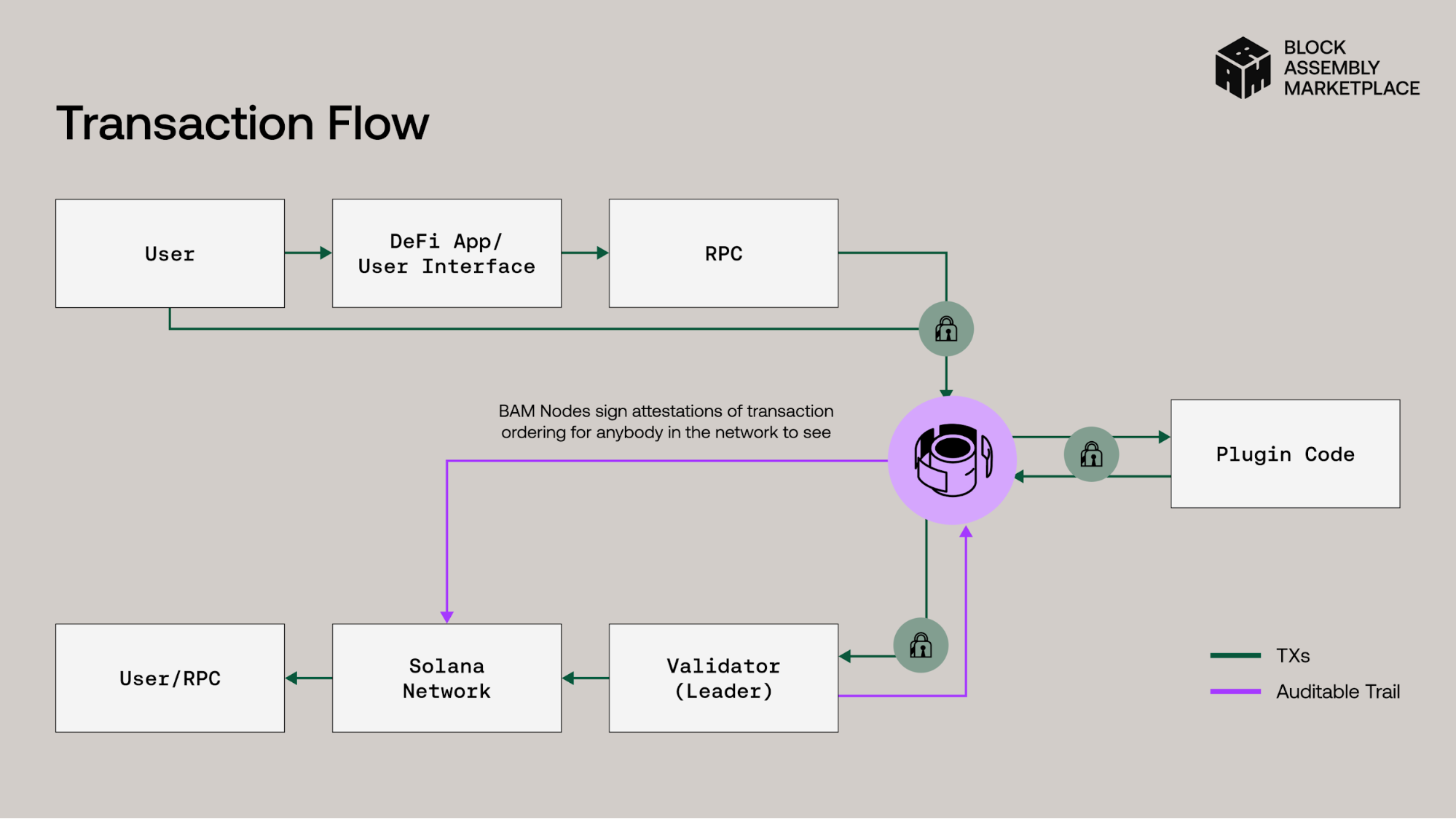

- BAM Nodes (scheduler nodes): Operated by Jito, these nodes form a hardware network utilizing Trusted Execution Environments (TEE) to receive and process encrypted transactions. They can privately filter and order transactions within a sealed environment while generating cryptographic proofs (attestations) that guarantee transaction ordering remains private before execution but is publicly verifiable.

- BAM Validators (execution validators): Validators running the updated Jito-Solana client execute transactions in the order provided by BAM Nodes and generate execution attestations. The process strictly adheres to the specified ordering, preventing any changes to transaction sequence.

- Plugins: Developers can build plugins to integrate with the BAM Node’s scheduling workflow, adding custom ordering rules. Plugins can prioritize oracle updates, order cancellations, or transactions from specific addresses, enabling business logic–driven ordering schemes.

The transaction workflow operates as follows:

- Users or applications send transactions to BAM Nodes.

- BAM Nodes order transactions within the TEE and generate ordering proofs. Through plugins, BAM Nodes can inject additional transactions, such as just-in-time oracle data updates. Once ordering is finalized, the BAM Node produces a cryptographic proof and submits the ordered transaction bundle to the current Leader node.

- The current Leader node processes the transactions in the specified order, returning execution results to the BAM Node to confirm order consistency and generate execution proofs.

- All proofs generated by BAM Nodes and Validators are published on-chain, creating a fully auditable trail. Any third party can verify that ordering and execution were unaltered and accountable.

The key innovation here lies in introducing the ordering marketplace, privacy handling, and on-chain verification—three elements that boost fairness and programmability—without changing Solana’s core consensus.

Features and Applications

BAM does more than optimize transaction ordering; it unlocks entirely new use cases:

- Just-in-time Oracle Updates: For instance, Pyth manages thousands of price feeds. By leveraging plugins, Pyth can inject price updates into the same block as corresponding user transactions, preventing stale pricing and reducing liquidation risks.

- High-Frequency Order Cancellation: Mirroring high-frequency market makers in traditional finance, BAM prioritizes order cancellation transactions, significantly improving execution efficiency and liquidity for on-chain order book DEXs—without network congestion from spam cancellations.

- Custom Ordering Logic: DEXs, NFT platforms, and perpetual protocols can implement custom prioritization, tailoring execution to meet their specific business needs.

These capabilities not only enhance user experience but also provide institutional traders with the compliance and execution assurances they require—potentially positioning Solana to attract more institutional capital.

Jito’s Role and Economic Model

The rollout of BAM further solidifies the role of Jito DAO within Solana’s MEV infrastructure. According to Jito, all protocol fees generated by BAM and the Jito Block Engine will accrue to the Jito DAO treasury going forward.

Moreover, plugin deployment introduces a new value-capture mechanism: developers may collect plugin fees from users, while BAM Nodes and Validators earn a share of revenue from ordering and execution services.

Jito Labs will continue to maintain BAM from a technical standpoint, while governance will shift to the DAO community, ensuring neutrality and supporting decentralized growth.

Roadmap and Ecosystem Partners

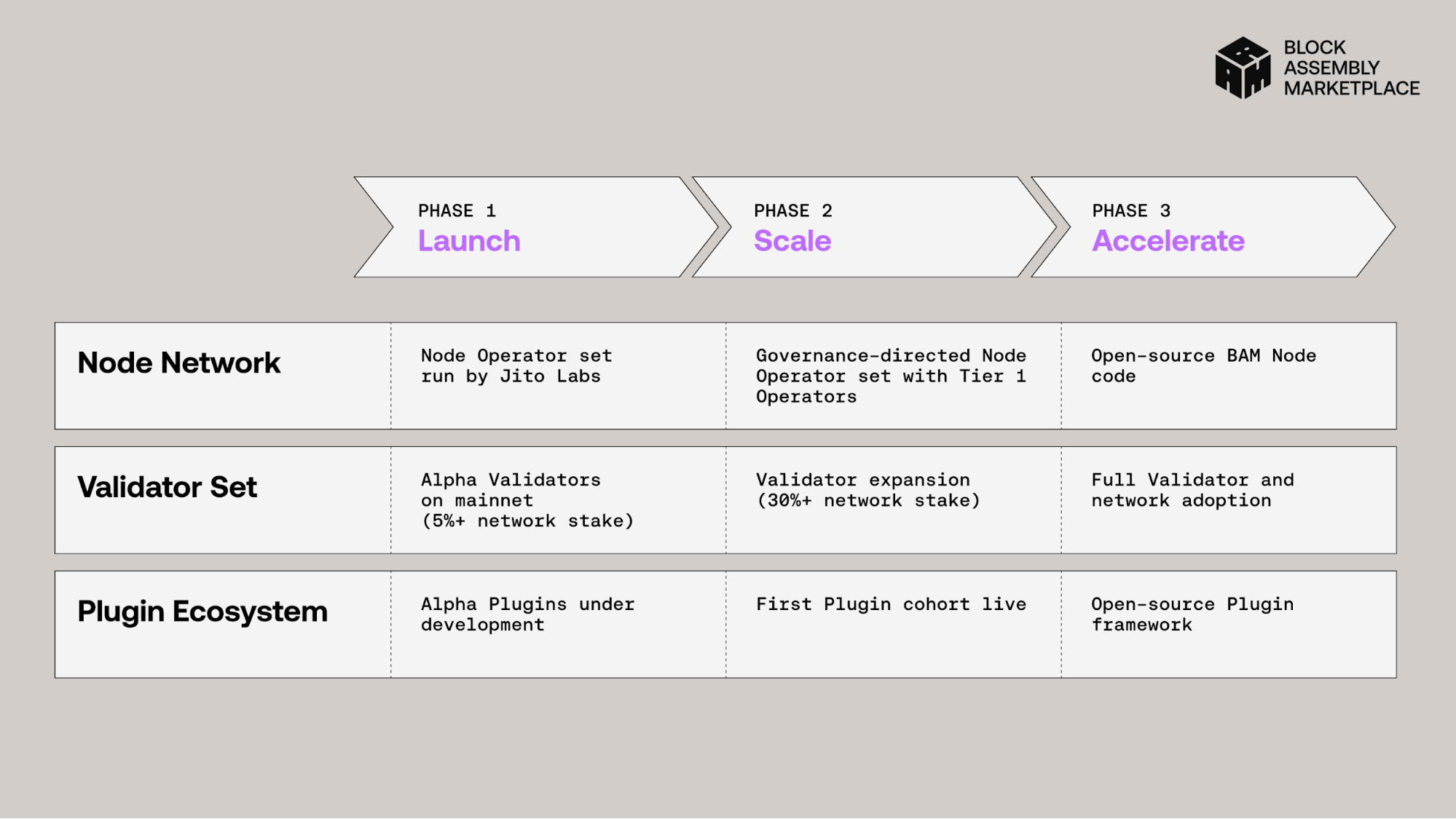

BAM’s rollout will occur in stages:

- Launch Phase: Jito Labs operates BAM Nodes, with early validator partners including Triton One, SOL Strategies, Figment, and Helius.

- Expansion Phase: Third-party BAM Node Operators can participate, targeting coverage of 30%+ of the Solana network’s staked tokens.

- Open Source and Acceleration Phase: BAM’s source code will be released to enable rapid plugin development and full decentralization of transaction construction.

Initial partners include core Solana ecosystem projects such as Drift, Pyth, and DFlow, with additional DeFi, oracle, and trading infrastructure initiatives expected in the future.

BAM: Potential and Challenges

BAM delivers more than faster performance or improved fairness—it shifts “ordering rights” from the protocol layer to developers and users, aligning on-chain trading with the determinism, privacy, and accountability of legacy financial markets and laying the foundation for DeFi 2.0.

Yet, BAM’s adoption also poses challenges: reliance on TEE security, complexity in plugin design, and how to balance decentralization remain open questions that require ongoing evaluation. Whether BAM can ultimately “make Solana win” remains to be seen.

Disclaimer:

- This article is republished from Foresight News, with copyright held by the original author Alex Liu, Foresight News. For republication concerns, contact the Gate Learn team; the team will respond promptly according to the appropriate procedures.

- Disclaimer: The views and opinions expressed are solely those of the author and do not constitute investment advice.

- All other language versions are translated by the Gate Learn team. Do not reproduce, redistribute, or plagiarize the translated articles without explicit citation of Gate.com.