NFT Market Cap Surges: The Drivers Behind the Revival

1. NFT Market Cap Surges Significantly

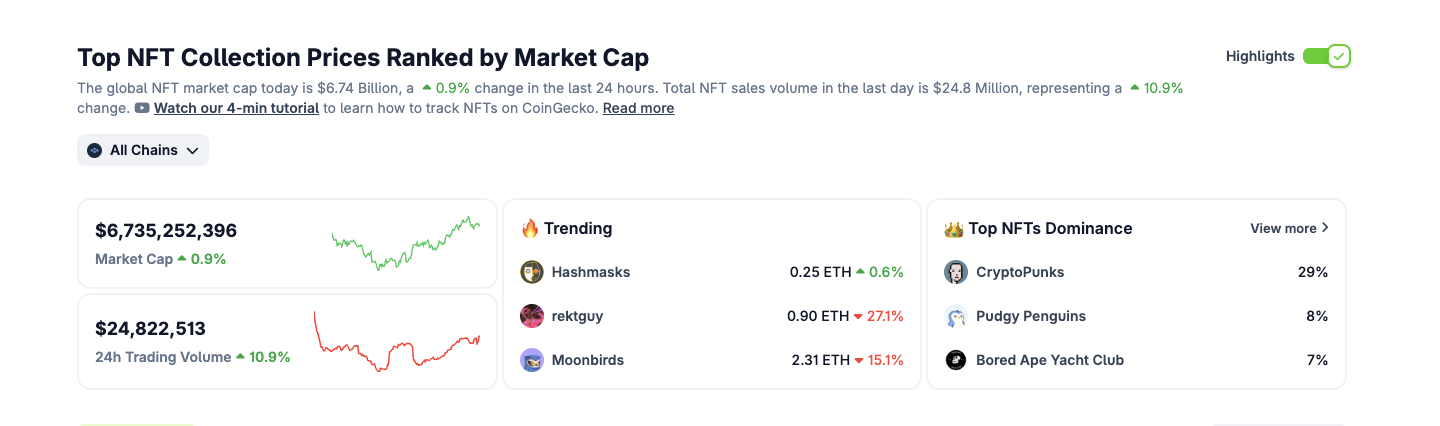

Chart: https://www.coingecko.com/en/nft

In July 2025, the total market capitalization of NFTs soared to around $6.6 billion, representing a 94% increase from June and setting a new high for the year. Over the past 36 days, aggregate capitalization also surged swiftly from $3.98 billion to $6 billion—a 66% cumulative increase. This trend underscores a significant rebound in valuations. The recovery of premiums for most NFT assets is evident, regardless of short-term selling pressure or long-term lockups.

2. Trading Volume and Floor Prices Climb Together

Rising market activity is another clear sign of recovery. Weekly trading volume in July reached $136 million, up 51% from the previous month, marking the strongest performance since February this year. Leading blue-chip projects saw broad-based gains in floor prices: CryptoPunks’ floor jumped 53%, with the average sale exceeding $190,000; Pudgy Penguins’ floor price spiked 66.7% month-over-month. The parallel rebound in both volume and price signals sustained buying power from institutions and major investors.

3. Top Blue-Chip Projects Lead the Comeback

Throughout this rally, blue-chip PFP (profile picture) collections have continued to serve as anchors for the market. Bored Ape Yacht Club has recently recorded several trades exceeding one million dollars, with whales acquiring multiple highly scarce NFTs in single transactions. The price stability and liquidity of these marquee projects have reinforced market confidence. Additionally, new investors are showing increased interest in high-value CryptoPunks sales on major platforms such as OpenSea.

4. New Frontiers: RWA and Gaming NFTs

Beyond PFPs, RWA (real-world assets) and gaming NFTs have remained highly active. Certain NFT assets backed by on-chain lending or yield rights now serve as stablecoin-like products, driving a 24% rise in trading volume since the beginning of summer. Popular Web3 gaming NFTs—including character and land assets—are seeing heightened demand, fueled by the anticipated launch of major blockchain games. Weekly trading volumes in July increased 18% compared to the previous month.

5. Investment Strategies and Risk Disclosures

- Diversification: Newcomers may consider allocating funds in a 50%/30%/20% ratio among blue-chip PFPs, RWAs, and gaming NFTs, respectively.

- Monitor Floor Prices: Declines in blue-chip project floors could present attractive entry opportunities.

- Risk Disclosure: The NFT market is subject to extreme volatility. Align your investment horizon with your risk tolerance and exercise caution regarding counterfeit or imitation projects.