Can Stablecoins Combine with AI? A Deep Dive into USD.AI’s New Mechanics

Coingecko data shows that the global stablecoin market cap has now exceeded $285 billion. Major players like Circle and Kraken are also moving aggressively into the stablecoin payments ecosystem.

Yet most stablecoin initiatives currently stick to traditional models, mainly pegging to the US dollar or US Treasuries, and generally lack innovation—many are seen as “playing it safe” or lacking originality. In this landscape, a disruptive challenger has emerged with a completely new approach.

Recently, the stablecoin project USD.AI, which uniquely merges DePIN, RWA, and AI, has attracted significant market attention. More than just dollar-pegged, USD.AI generates returns by collateralizing AI hardware, addressing the unserved financing needs for computing resources.

Earlier today, USD.AI officially went live and opened its deposit channel, with activity spiking rapidly. This could create fresh opportunities at the intersection of AI and stablecoins.

Project Background

According to Rootdata, this project was founded in 2024. Among the founding team, USD.AI’s core founder David Choi is also the co-founder and CEO of MetaStreet, a prominent NFT lending platform, and a former investment banking analyst at Deutsche Bank.

What really put USD.AI in the spotlight is its eye-catching funding story.

On June 14, 2024, USD.AI announced a $13.4 million Series A round led by Framework Ventures.

Framework Ventures, known for backing DeFi and infrastructure leaders like Uniswap and ChainLink, took the lead, signaling institutional confidence in USD.AI’s innovative value. The investor roster is equally impressive, with the likes of crypto VC Dragonfly, Layer 2 giant Arbitrum, and recently public exchange Bullish also on board.

Such a stellar lineup not only delivers substantial resources to USD.AI, but also demonstrates top investors’ growing interest in stablecoins integrating DePIN and AI. Expectations for the project have soared. Right after announcing its raise, USD.AI went live on the 19th, sparking broad market debate.

How It Works and Core Mechanisms

As demand for AI computing power grows, USD.AI was built to combine stablecoin protocols with AI infrastructure financing, targeting pain points left unaddressed by other projects:

Many small and midsize AI companies own expensive GPU hardware but struggle to secure capital through traditional financial channels.

The project’s core objective is to use on-chain capital to support AI companies in hardware procurement and operations, filling the funding gap left by traditional finance in the emerging AI economy, and preserving stablecoins’ low-risk profile.

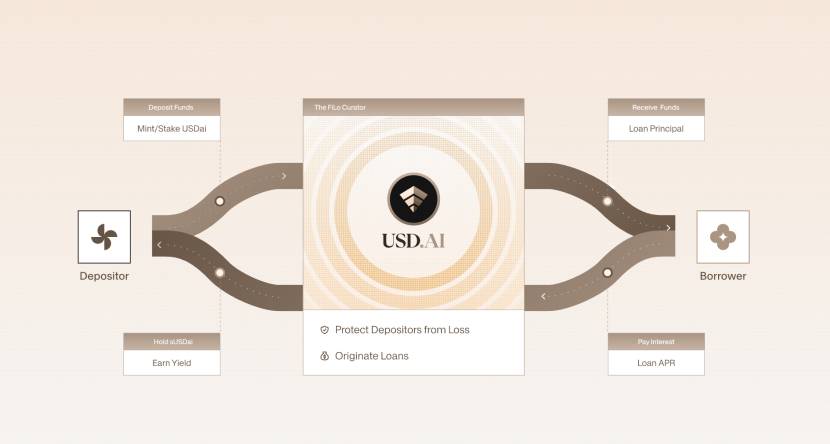

USD.AI’s design revolves around a closed loop of “collateral-mint-invest-yield,” blending today’s hot RWA and AI trends, and establishing a truly innovative position in the current wave of stablecoin products.

Here’s how it works: Users deposit stablecoins such as USDT or USDC as collateral to mint USDai at a 1:1 ratio. USDai is backed by US Treasuries and leading stablecoins to ensure a dollar peg, instant redemption, and liquidity, making it suitable for DeFi trading or liquidity provision. Users can also stake USDai to receive sUSDai tokens and deploy them in other DeFi protocols for extra yield—delivering true “one token, many uses.”

USD.AI channels user funds into two main asset categories: (1) making loans to AI firms for GPU and hardware procurement, generating attractive yields—currently shown as an annualized rate of 6.96% on USD.AI’s official website; (2) if funds are idle, they are invested in US Treasuries for stable base returns. Holders of sUSDai can leverage DeFi for boosted yields (USD.AI’s official website targets 15%-25% APY), while USDai holders enjoy stable, lower-risk income.

USD.AI’s innovative edge comes from several core mechanisms:

1. Dual-token system: USDai is a low-risk stablecoin for conservative users. sUSDai targets yield-seekers, offering greater flexibility and higher risk/reward. This setup serves different risk appetites while staying compatible across DeFi.

2. Asset tokenization and the Caliber framework: Through the CALIBER framework, USD.AI turns AI hardware and other physical assets into on-chain tokens. Legal and technical safeguards guarantee transparent, enforceable ownership, and an on-chain insurance mechanism minimizes default risk.

3. QEV redemption mechanism: To tackle the long-term, illiquid nature of AI infrastructure, the QEV system manages sUSDai redemptions in a market-driven way—avoiding first-come-first-served inefficiencies, and ensuring fairness and protocol stability.

4. FiLo Curator expansion mechanism: This lets the protocol onboard new borrowers at scale, broadening its AI infrastructure lending portfolio, while structured protections and risk-alignment features safeguard users and support sustainable, diversified yield streams.

In summary: USD.AI deploys user deposits transparently and verifiably, lending them to AI companies that need GPU-powered computing for interest income. Idle funds go into US Treasuries as a yield floor.

This innovative structure gives USD.AI a clear edge. Compared with old-school stablecoins, USD.AI unlocks higher returns via AI infrastructure investing; compared with high-risk DeFi protocols, its risk isolation and insurance mechanisms substantially reduce systemic risk.

USD.AI is not just revitalizing the stablecoin sector—it’s offering scalable capital solutions for the AI economy and may well become a leading project at the intersection of stablecoins and AI infrastructure.

How to Participate

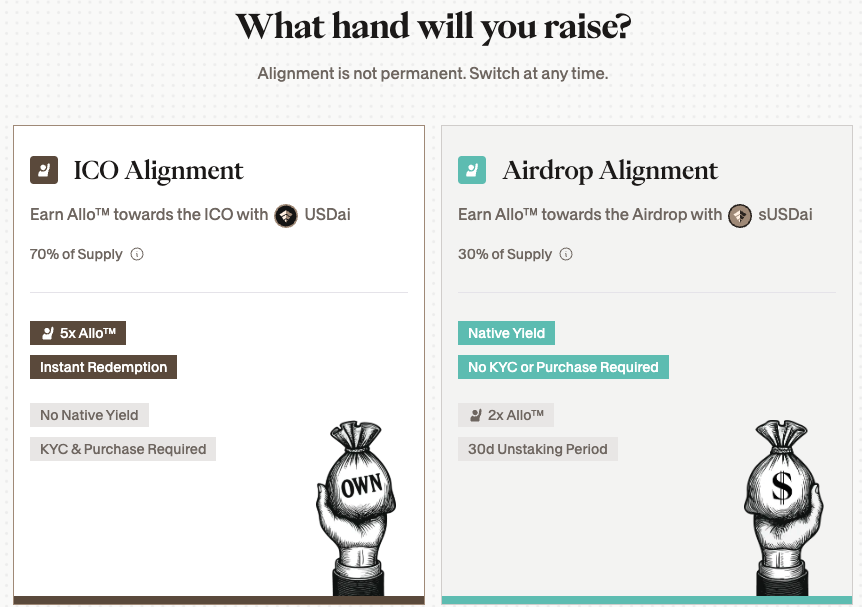

USD.AI is open for user deposits and for inviting others to earn Allo Points in its native rewards program.

Users can earn final token rewards via two avenues: ICO or airdrop. All participants enter at a $30 million circulating supply valuation (which is 10% of the $300 million total FDV).

Official communications indicate that minting or staking USDai will continuously earn users points each day. Users can adopt different strategies to ultimately receive either ICO allocations or airdrop rewards.

The Allo Points event ends when YPO (total payout) reaches $20 million. KYC is required for ICO allocations; airdrop participants do not need KYC.

For advanced Allo Point strategies, watch the official video post.

To participate in the ICO, hold USDai. To participate in the airdrop, stake USDai to obtain sUSDai.

Currently, buying USDai or sUSDai gives you qUSDai, which is a deposit queue receipt that automatically converts to the corresponding token within 24 hours.

USD.AI currently has a $100 million total deposit cap. Since all new deposits are in qUSDai status, the Total Value Locked (TVL) only reflects the $52 million deposited during the testing phase.

Market Perspectives

There is significant division in market opinion regarding USD.AI.

Fans say USD.AI introduces real innovation in the stablecoin space, blending the hottest AI themes. It lets users access stable yields and AI-based upside all in one. Multiple participation strategies mean all user types can find a suitable approach, combining the “stable” nature of stablecoins with high-risk/high-reward options.

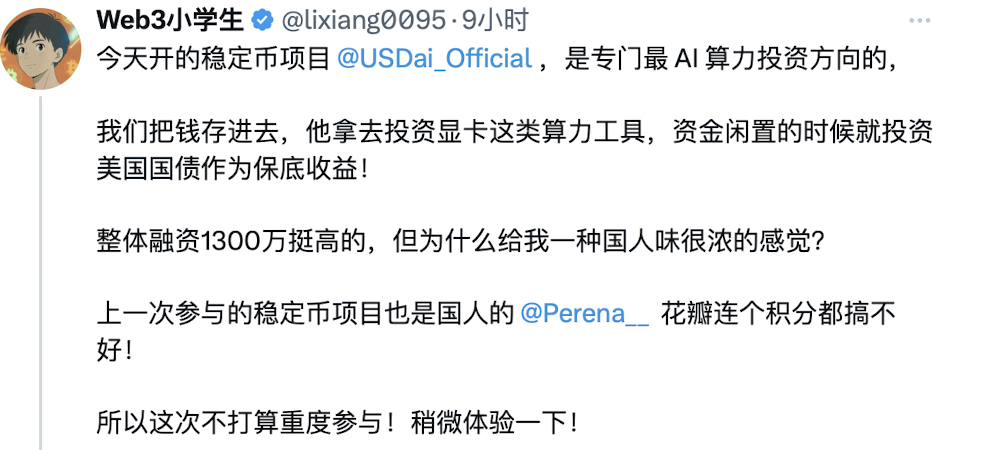

Critics counter that available information suggests a mostly Chinese team, and argue the project simply combines popular industry terms without meaningful innovation.

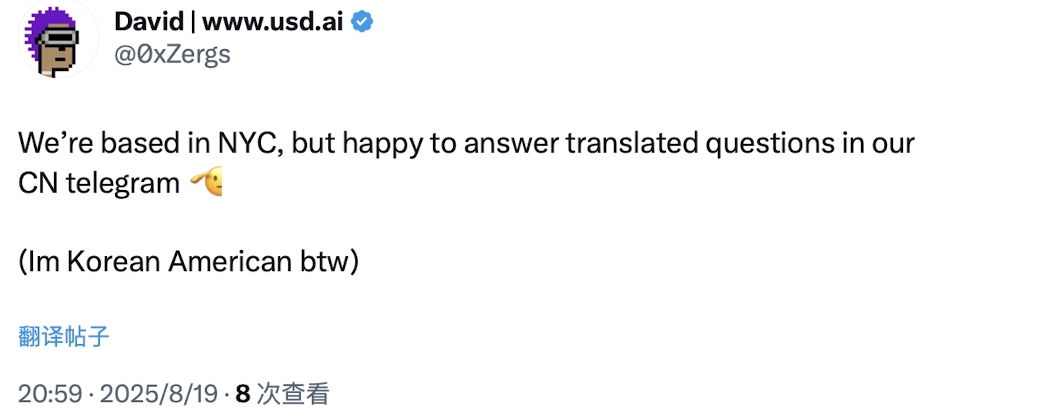

Notably, USD.AI’s founder David recently responded under a FUD post, clarifying that he is Korean-American, the project is headquartered in New York, and he welcomes questions from Chinese-speaking users.

In my view, USD.AI does bring a fresh answer to the stablecoin challenge. Whether it gains real traction, however, depends on whether the market demonstrates adoption through user participation and rapidly hits the $100 million TVL cap.

Its ultimate fate will serve as a key benchmark for how willing the market is to embrace this emerging “AI infrastructure + stablecoin” narrative.

Disclaimer:

- This article is republished from [伞,深潮 TechFlow]. Copyright for the original text belongs to [TechFlow]. For republishing concerns, please contact the Gate Learn team, which will expedite the issue per procedures.

- Disclaimer: The views and opinions expressed in this article reflect only the author’s personal perspective and do not constitute investment advice.

- Other language versions have been translated by the Gate Learn team. Replication, distribution, or plagiarism of the translated article is prohibited unless Gate is cited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

What Is USDT0