BTC Price Prediction: Bitcoin Struggles Below $120K, Is a Breakout or Breakdown Coming Next?

BTC Market Overview

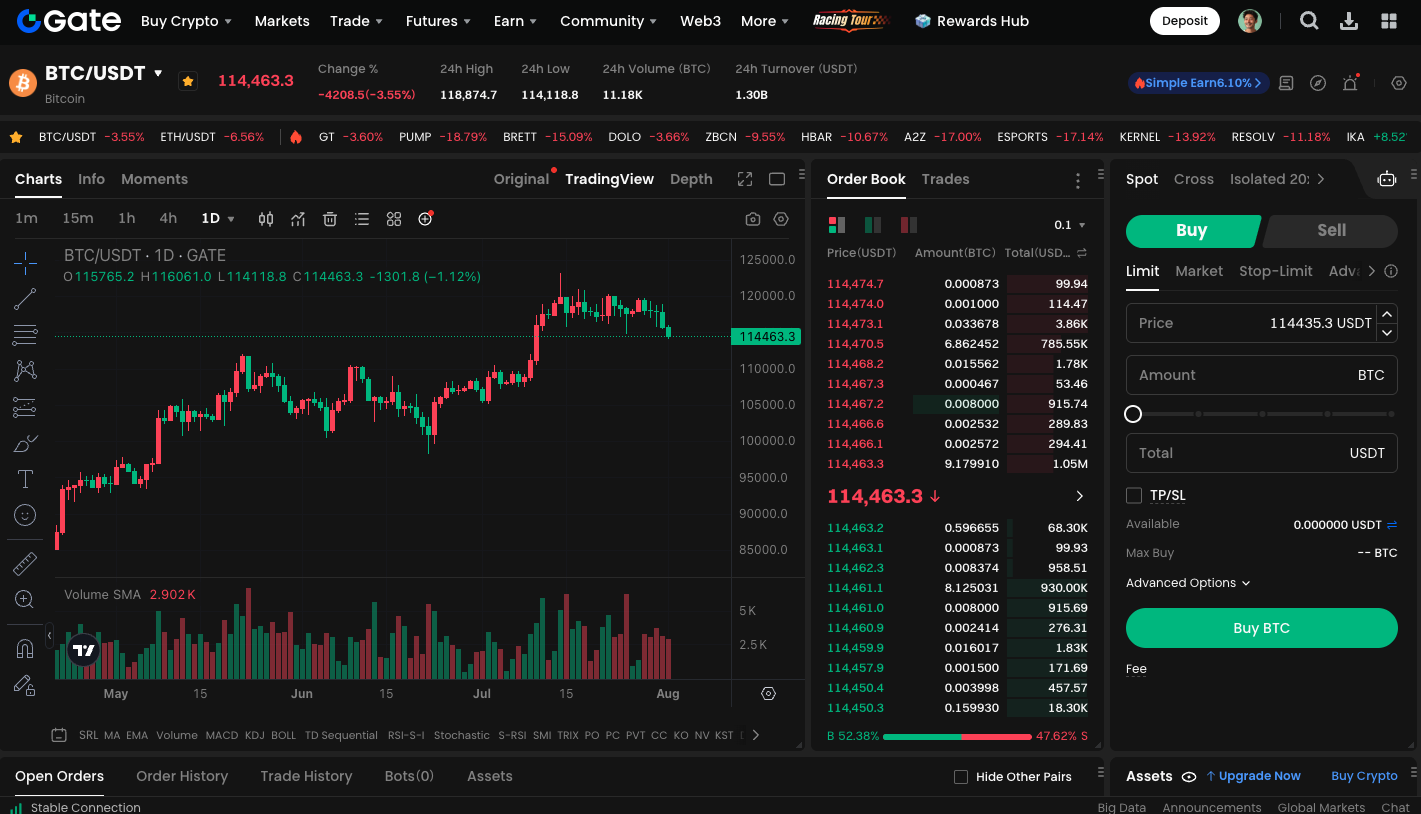

Bitcoin (BTC) has recently encountered persistent resistance at the $120,000 level and is currently consolidating within the $114,000–$119,500 range. After pulling back nearly 5% from its recent high, BTC currently trades around $114,700. While upward momentum remains limited, some analysts emphasize that this phase may be a period of accumulation ahead of another move higher, rather than an indication of an impending trend reversal.

Rising New Investor Activity

CryptoQuant analyst AxelAdlerJr, analyzing changes in investor composition, asserts that Bitcoin is now in a healthy late-stage bull market. Data shows that new investors currently represent 30% of the overall market, well below the local peaks of 64% and 72% seen in March and December 2024, respectively. This lower proportion of new investors suggests the market is not overheated. Although some long-term holders have started to distribute their coins, overall selling pressure remains controlled, indicating that current price movements are part of an orderly absorption process.

Institutional Capital Accelerates Bitcoin Yield Strategies

In addition to price factors, institutional capital is increasingly driving Bitcoin yield generation. Decentralized finance platform Solv Protocol has recently launched BTC+ structured yield vaults designed specifically for institutions. These vaults combine DeFi, CeFi, and traditional finance strategies to help idle BTC holdings generate stable returns.

This type of yield product has also attracted other major institutions, including Coinbase and XBTO. They have launched BTC yield-generating products for institutional clients, with target annualized returns between 5% and 8%. Additionally, prominent Bitcoin-holding companies such as MicroStrategy and MARA Holdings have begun allocating a portion of their assets to yield strategies, enhancing shareholder value and capital efficiency.

Financialization Drives Regulatory Advancements

Since the U.S. SEC approved spot Bitcoin ETFs, institutional participation has surged, fueling a more than 156% increase in Bitcoin’s price year-to-date and pushing its market capitalization above $2.5 trillion. Even mortgage agencies Fannie Mae and Freddie Mac have been directed to assess how to incorporate crypto assets into their risk management models. This indicates Bitcoin’s steady movement into the mainstream financial system.

Start trading BTC spot now: https://www.gate.com/trade/BTC_USDT

Summary

Although BTC faces short-term price consolidation and some investor hesitation, technical indicators and capital structure point to ongoing upside potential. The market stands at a critical inflection point, awaiting a breakout. If capital inflows and investor confidence increase, Bitcoin may test the $120,000 mark or even higher in the weeks ahead. Conversely, if the consolidation phase lingers or macroeconomic pressures mount, BTC may first need to retest intermediate support around $110,000–$112,000.