- Topic1/3

18k Popularity

10k Popularity

34k Popularity

8k Popularity

23k Popularity

- Pin

- 🎉 The #CandyDrop Futures Challenge is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win.

- 🎉 Gate Square Growth Points Summer Lucky Draw Round 1️⃣ 2️⃣ Is Live!

🎁 Prize pool over $10,000! Win Huawei Mate Tri-fold Phone, F1 Red Bull Racing Car Model, exclusive Gate merch, popular tokens & more!

Try your luck now 👉 https://www.gate.com/activities/pointprize?now_period=12

How to earn Growth Points fast?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to earn points

100% chance to win — prizes guaranteed! Come and draw now!

Event ends: August 9, 16:00 UTC

More details: https://www

Web3 Research Weekly Report|This week's market shows a slight warming trend; the tariff exemption policy has triggered a positive response in the crypto market.

Weekly Overview

This week, the cryptocurrency market experienced a slight rebound driven by Trump's tariff exemption policy, but the actual increase was relatively limited and concentrated among the leading mainstream coins. Overall, the market is still in a state of structural adjustment, and the future trend of the market will continue to be significantly influenced by external factors. Recently, although the mainstream coins have shown notable fluctuations in their prices, their overall ability to withstand external shocks remains strong.

Most mainstream cryptocurrencies in the market this week have shown a slight warming trend. Due to the timely adjustment of Trump's tariff policy, the US stock market and cryptocurrency market have been positively affected. However, there are still no significant signs of a large-scale market rebound overall this week.

Overall, the market saw a slight recovery after opening this week, with most major cryptocurrencies showing a general upward trend. However, due to the lack of significant changes in the external environment, the weekly trend remained relatively calm, staying within a small range. As we approach the end of the week, the mainstream market remains in a state of slight fluctuations.

This week, the price of BTC has shown a significant rebound. Currently, after rising above $86,000, there has been a slight drop, maintaining around the $85,000 level. The subsequent trend is likely to continue to be greatly influenced by external factors.

The price trend of ETH over the past week is similar to that of BTC, experiencing a significant drop after reaching a weekly high, which was around $1682. It is currently maintaining around $1600.

This week, the price trends of key mainstream cryptocurrencies have generally shown a slight recovery. Currently, the overall market capitalization of the crypto market has increased compared to the same period last week, reaching around 2.68 trillion USD, with a rise of about 1.54% in the last 24 hours. The price of BTC is currently around 85052 USD. The price of ETH is maintaining around 1600 USD.

The cryptocurrency market overall remains in a structural adjustment cycle this week. Most mainstream coins have seen price increases due to external factors, but the overall magnitude is not significant. The coin with the highest increase this week is RAY, which reached around 38% over the week, mainly due to the launch of LaunchLab after the Pump.fun event, enabling seamless token creation. This has increased liquidity for the Raydium AMM platform, driving up the price of the RAY token recently.

This weekend, the cryptocurrency market is likely to maintain a slight fluctuation trend, with rapid ups and downs within a certain range likely to occur again. The possibility of a significant overall decline is relatively small, and the price changes of major cryptocurrencies will still depend on the impact of external news factors.

Crypto Market

🔥According to a report by Bloomberg, President Trump and his family have ventured into nearly every area of the cryptocurrency industry. According to public data calculations, even considering the market fluctuations triggered by the latest round of trade wars, the total paper profit from these projects is still close to $1 billion.

🔥 According to CoinDesk, JPMorgan CEO Jamie Dimon is preparing to address the turmoil in the nearly $30 trillion U.S. Treasury market, while the Federal Reserve will only act when they start to feel a bit of panic. The U.S. Treasury market plays a central role in global finance, setting the tone for all market factors from mortgage rates to corporate bond yields.

🔥CryptoQuant analyst mignolet stated that Bitcoin whales have not exited the market, and the current trend is similar to the accumulation seen during the sideways consolidation period from August to September last year. What we are witnessing now is likely just a pullback within a continuing bull market cycle (albeit a significant one), rather than a structural crisis that triggers an exit from "whale" levels. Once this false crisis is resolved, quantitative easing policies will be restarted. Following gold, the next major beneficiary of this wave of liquidity will be Bitcoin.

🔥According to Cointelegraph, Bitcoin has reversed most of its earlier losses this week after Trump announced a temporary suspension of tariffs.

🔥According to CNBC, Larry Fink, CEO of asset management giant BlackRock, hopes that all assets (from stocks to bonds, real estate, etc.) can be traded online on the blockchain. He stated that the concept of "tokenization" will fundamentally change financial ownership and investment, with every asset being able to be tokenized.

🔥Veteran futures and options trader Jim Iuorio analyzed the recent weakness in Bitcoin performance in an article on the CME Group's official website. He pointed out two main reasons: first, after Bitcoin reached its peak of $109,000 in mid-January, the positive news has been digested by the market, and once the expected news is confirmed, traders choose to sell, leading to an increase in the liquidation of long positions; second, many institutional traders have included Bitcoin and the Nasdaq index in the same investment portfolio, and when the Nasdaq falls sharply, it triggers Bitcoin sell-offs to meet margin requirements.

🔥 Senior analyst James Van Straten stated in a post that the S&P volatility index has surged to its highest level since August of last year, indicating increased market uncertainty. The ratio of Bitcoin to VIX has reached a long-term trend line at 1903, the last time it touched this trend line was during the market volatility around the unwinding of yen arbitrage trades.

🔥According to Cointelegraph, Michael Saylor, founder of Strategy (formerly MicroStrategy), stated at an event that Bitcoin does not need the United States; the United States needs Bitcoin.

🔥According to a report by Cryptoslate, a survey conducted by Harris Poll found that approximately 55 million (21% of the total population) American adults own cryptocurrency, and 76% of holders believe that their experience with digital assets has had a positive impact on them personally.

🔥According to Cryptodnes, BlackRock CEO Larry Fink warned of a potential economic recession in an interview with CNBC, stating that the recession may have already begun. Larry Fink pointed out that rising economic pressures and protectionist trade policies are key driving factors behind what he views as a slow economic contraction.

🔥Santiment stated that Trump's weekend tariff exemption policy triggered an instant rise in the cryptocurrency market.

🔥According to Crypto.news, data from CryptoSlam shows that NFT trading volume dropped 4.7% to $94.7 million on Monday.

🔥McKenna, managing partner of Arete Capital, stated that the market often bottoms out amid the worst news. He mentioned that due to reciprocal tariffs and the stock market decline, Bitcoin had previously dropped to $74,000, which he described as one of the most severe panics he has seen in the market. He believes that unless relations with China deteriorate significantly, future news will only cause fluctuations in the market.

🔥The Chief Sustainability Officer of the Hong Kong Stock Exchange Group, Zhou Guanying, stated that the use of new technologies such as blockchain could make the tracking of carbon credits more transparent and efficient, and help with cross-border transactions. Therefore, the Hong Kong Stock Exchange is open to using technologies like blockchain to address existing issues in the carbon market.

🔥Alex Thorn, the research director at Galaxy Digital, posted on X stating that based on the review of public documents, bankruptcy filings, and voluntary disclosures from active lenders, the total scale of centralized finance (CeFi) loans is projected to be $11.2 billion by the end of 2024, a 68% decrease from the historical peak (ATH) of $34.8 billion in 2022.

🔥Arthur, the founder and Chief Investment Officer of DeFiance Capital, stated on platform X that the biggest problem currently troubling the liquidity cryptocurrency market is how projects and market makers collaborate to create artificially sustained prices over the long term, a process that is entirely opaque.

🔥According to a report by Cointelegraph, based on Bitwise's "2025 Q1 Corporate Bitcoin Adoption Report", in the first quarter of 2025, public companies purchased a total of 95,431 bitcoins, an increase of 16.11% compared to the previous quarter, bringing the total bitcoin holdings of public companies to 688,000 coins, which accounts for 3.28% of the total supply of 21 million bitcoins. The number of public companies holding bitcoins reached 79, an increase of 17.91% compared to the previous quarter, with 12 new companies purchasing bitcoins during this quarter.

🔥According to Cointelegraph, Mantra CEO John Mullin responded to community concerns following the significant drop in the OM token. He assured that Mantra and its partners are working to revive the OM token, but details regarding the buyback and burn are still being formulated.

🔥According to a report by CoinDesk, Visa will join the Global Dollar Network (USDG) stablecoin alliance initiated by Paxos, becoming the first traditional financial institution to join. Other alliance members include Robinhood, Kraken, Galaxy Digital, Anchorage Digital, Bullish, and Nuvei. USDG aims to share stablecoin profits with members to incentivize the construction of liquidity and interoperability, distinguishing itself from profit-retaining models like Tether.

🔥Laser Digital issued a statement on platform X stating that it is unrelated to the recent price drop of $OM (Mantra). In response to rumors on social media regarding Laser's involvement in investor sell-offs, the company stated that the claims are "factually incorrect and misleading."

🔥According to The Defiant, Bitcoin has performed exceptionally well across all time periods, outperforming the S&P 500 every year for the past 14 years. During this time, Bitcoin has achieved a return of approximately 7.2 million%, far exceeding gold's 116% return and the S&P 500's 306% return. Over a shorter time frame, Bitcoin's return over the past two years has been 173%, further solidifying its dominance compared to traditional investment assets like gold and the S&P 500.

🔥According to Ledger Insights, a recent survey by the Bank for International Settlements regarding central bank reserves shows that in 2024, 15.9% of central bank respondents indicated that they would consider investing in digital assets or currencies within five to ten years. However, in the 2025 survey, the proportion of central banks considering investing in cryptocurrencies within the same timeframe was only 2.1%.

🔥According to a report by Phoenix News, State Street Global Advisors Hong Kong Limited announced the launch of the "State Street Galaxy" application for crypto and traditional investments in partnership with Galaxy Asset Management, a subsidiary of Galaxy Digital Holdings.

🔥 Matthew Sigel, head of digital asset research at VanEck, has proposed a new type of debt instrument called BitBonds, which combines U.S. Treasuries with Bitcoin exposure as a new strategy to manage the government's upcoming $14 trillion refinancing needs, Cryptoslate reported.

🔥Tether announces a strategic investment in the fintech company Fizen, which focuses on self-custody wallets and digital payments, aiming to enhance the practical application of stablecoins and payment infrastructure globally. Fizen enables users to make payments using stablecoins and facilitates fiat currency settlement through methods such as QR codes, without the need for additional hardware, helping to break down barriers to financial services and improve merchant access efficiency.

🔥 According to an official announcement from ZKsync, the security team discovered that an administrator account of the airdrop contract was compromised. The attacker controlled and sold approximately $5 million worth of unclaimed ZK airdrop tokens. The incident was caused by a single key leak and did not affect the protocol itself or the ZK token contract; user funds remain secure.

🔥According to The Block, investment bank TD Cowen has issued a warning that political risks in the crypto industry are rising, as actions by U.S. President Trump and his administration may hinder progress on cryptocurrency regulation.

🔥According to CryptoSlate, Mantra CEO John Patrick Mullin proposed to burn the OM tokens he holds to restore investor confidence after the price of the protocol's native token plummeted.

🔥Nasdaq-listed medical technology company Semler Scientific has filed an S-3 registration statement with the U.S. Securities and Exchange Commission (SEC) to issue $500 million in securities. The proceeds from this issuance will primarily be used for general corporate purposes, including but not limited to the purchase of Bitcoin.

🔥According to Fortune, Trump is preparing to launch a real estate-themed crypto game centered around his brand. Two insiders say the game is similar to Monopoly GO! and is being developed by his long-time business partner Bill Zanker. The project is part of the Trump family's crypto strategy, which has already ventured into NFTs, stablecoins, DeFi, and Bitcoin mining. Although Zanker denies any link to Monopoly, the project is expected to go live in late April, with no details yet disclosed on how blockchain technology will be utilized.

🔥According to The Block, Federal Reserve Chairman Jerome Powell stated that future regulations regarding banks and cryptocurrencies may be "eased."

🔥According to Protos, DeFi users have recently encountered a new type of scam: scammers take over the official websites of abandoned projects and lure old users into signing malicious "drain funds" transactions. This passive scam differs from traditional active scams, as it specifically targets old users who may still have bookmarks of old projects.

🔥 Bitdeer (stock code BTDR) Chairman and CEO Wu Jihan issued a statement on X, seemingly in response to the short-selling report on BTDR. He stated that the report is based on preconceived positions, piecing together complex but irrelevant facts, and constructing a narrative using absurd and misleading logic, with the aim of manipulating market sentiment for the benefit of short-sellers. He emphasized that the company will continue to focus on the fundamentals of its actual business and long-term value creation, while reserving the right to take legal action to protect the company's reputation and shareholders' interests.

🔥According to Cointelegraph, some market makers are turning token loans into a profit machine, trapping small crypto projects in a death spiral. It is reported that a market maker model known as the "loan option model" allows project teams to lend tokens to market makers, who then use these tokens to provide liquidity, stabilize prices, and assist projects in launching on crypto trading platforms. However, behind the scenes, some market makers are exploiting this controversial token loan structure for their own profit. These agreements are often packaged as "low risk, high return," but in reality, they can severely impact token prices, leaving nascent crypto teams in chaos and struggle.

🔥According to Bitcoin.com, ENS chief developer Nick Johnson revealed a sophisticated phishing attack that exploited a vulnerability in the Google system, particularly the recently patched OAuth flaw.

🔥According to a report by The Block, VanEck plans to launch a new crypto-related ETF next month, with the trading code NODE. This ETF aims to provide investors with access to a broader crypto economy by investing in financial instruments and stocks related to cryptocurrency exchanges, Bitcoin miners, and data centers.

Regulation & Macroeconomic Policy

🔥According to Cointelegraph, Tim Scott, the chairman of the U.S. Senate Committee on Banking, Housing, and Urban Affairs, recently stated that the cryptocurrency market structure bill is expected to become law by August 2025. Tim Scott also noted that the Senate Banking Committee has advanced a comprehensive stablecoin regulatory bill—the GENIUS Act—in March 2025, indicating that the committee is prioritizing crypto policy.

🔥The U.S. Securities and Exchange Commission (SEC) has decided to extend the review period for the rule change proposal submitted by NYSE Arca. The proposal aims to allow the Grayscale Ethereum Trust ETF and the Mini Trust ETF to stake the Ethereum they hold.

🔥According to The Defiant, the U.S. Securities and Exchange Commission (SEC) has postponed its decision on the physical purchase and redemption of spot Bitcoin and Ethereum ETFs from WisdomTree and VanEck until June 3, 2025. Physical trading involves the direct exchange of underlying assets, such as Bitcoin and Ethereum, rather than cash.

🔥According to Barron's, the Anti-Money Laundering and Financial Crimes Division of the U.S. Department of Homeland Security has launched an investigation into the crypto custodian bank Anchorage Digital Bank. The company, backed by Wall Street capital, has publicly supported Trump's policies in the digital asset space. The investigation focuses on its compliance and financial transaction practices, with details yet to be disclosed.

🔥According to Bitcoin Magazine, Bo Hines, the Executive Director of the President's Advisory Council on Digital Assets, stated that the United States may use tariff revenue to purchase Bitcoin.

🔥According to a report by The Block, Standard Chartered Bank's latest report predicts that the upcoming "Stablecoin Regulatory Framework" (GENIUS Act) in the United States will drive the global stablecoin market from its current size of $230 billion to $2 trillion by the end of 2028.

🔥The Financial Services Regulatory Authority (FSRA) of the Abu Dhabi Global Market has imposed a total fine of $12.45 million on the cryptocurrency company Hayvn and its former CEO Christopher Flinos for processing client transactions through an unlicensed SPV entity AC Holding since 2018, lacking effective anti-money laundering controls for a long time.

🔥According to crypto journalist Eleanor Terrett, the U.S. Securities and Exchange Commission (SEC) has announced details of its third cryptocurrency policy roundtable, which will focus on custody issues at the meeting on April 25. There will be two panel discussions—one on broker-dealer and wallet custody, and the other on investment advisor and investment company custody.

🔥According to lawyer James K. Filan, the "stay of appeal" motion jointly submitted by the SEC and Ripple has been approved by the court. The SEC must submit a case status report within 60 days of the order being issued.

🔥According to a report by Reuters, a senior official from the Russian Ministry of Finance stated on Wednesday that, after the stablecoin USDT held in a digital wallet associated with Russia was frozen last month, Russia should develop a domestic stablecoin pegged to other currencies.

🔥According to The Block, Mayer Mizrachi Matalon, the mayor of Panama City, stated on the X platform on Wednesday that the Panama City government has approved the use of cryptocurrency to pay taxes, fees, fines, and permits.

🔥According to Cointelegraph, the HB 92 bill in North Carolina has been passed by the House Pension and Retirement Committee. The bill allows the state treasurer to invest in qualified digital assets such as Bitcoin.

Crypto Market Highlights

⭐️In the past week, the overall cryptocurrency market continues to be influenced by external factors. With the introduction of Trump's tariff exemption policy, mainstream financial markets have mostly shown signs of recovery, while the crypto market has mainly experienced slight increases, remaining in a structural adjustment phase. Over the past week, mainstream cryptocurrencies have mainly seen continuous short-term fluctuations, with an overall slight upward trend. Currently, the market is in a short-term upward channel, and the current trend is expected to continue.

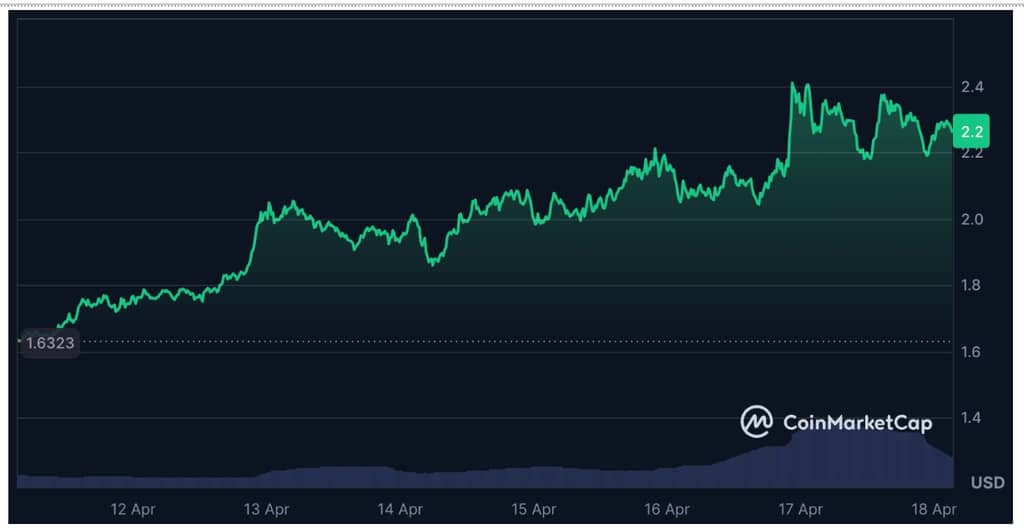

⭐️This week, RAY has the highest increase among mainstream cryptocurrencies, reaching about 38%. This is mainly due to the recent LaunchLab launched after the Pump.fun event, which has increased liquidity in the short term, driving up the price of RAY. Currently, the price of RAY is around $2.2, with a weekly high of about $2.4. It is currently in a state of short-term volatility, with a slight price decline.

Bitcoin & Ethereum Weekly Performance

Bitcoin (BTC)

This week, the BTC price trend continued last week's market after the opening, showing a continuous intraday rise and fall trend, with the price falling to a one-week low of $83,000, followed by multiple rounds of short-term ups and downs. Affected by external news factors, BTC price also hit a one-week high of $86,400, and although it fell again, it basically remained in the range of $83,000-85,000. BTC price trend in this week performance is acceptable, $83,000 as the key price support level, BTC price trend for a week is relatively firm, the follow-up currency will most likely continue to follow the overall trend of the market, maintaining a small range of continuous ups and downs will be the short-term mainstream market state.

Ethereum (ETH)

The price trend of ETH this week has roughly maintained a consistent relationship with BTC, but the fluctuations have been relatively smoother. The price of ETH reached a high close to $1700 during the week, then decreased mid-week to around the weekly low of $1540. Currently, the price of ETH has once again fallen below the key level of $1600, and the subsequent trend is expected to remain within a small range of continuous fluctuations. At present, the price of ETH is fluctuating around $1580, and a new price adjustment is expected to occur over the weekend.

Trends in Web3 Projects

This week, the total market value of the seven types of projects showed mixed trends, but the fluctuations mostly remained within a small range. The market index this week continued to be significantly affected by external factors, with a noticeable slight warming trend. It is expected that the current market trend will continue during the weekend closing period.

| Project Category | Weekly Change | Top Three Tokens by Weekly Increase | Overview | | ------------ | ------------ | ------------ | ------------ | | Layer 1 | 1.7% | NETZ, BLD, DEC | The market capitalization of the Layer 1 sector saw a slight recovery this week, but the top coins did not show significant increases, remaining within a moderate range. Overall, most projects maintained a small range of fluctuations this week. | Layer 2 | -4.3% |COMBO,FHE,PEPU|The Layer 2 sector continued its downward trend this week, with only a few cryptocurrencies showing an upward trend, while the majority continued to decline. | DeFi | 0.5% | BOR,COMBO,SYNO | The total market value of the DeFi sector saw a slight recovery this week, but the increase in leading coins was mainly concentrated in a few specific coins, while most coins in the sector did not show any particularly obvious upward trends.| | NFT |3.4% | COMBO,BFOX,REALM | The total value of the NFT market saw a certain recovery this week, with the leading rising coins mainly being comprehensive projects, and most coins within the sector experienced a slight recovery.| | MEME | 0.3% | DWOG,MUNCAT,CATEX| The MEME coin sector saw a slight increase this week, but it remained basically flat compared to the same period last week, with the leading upward coins showing a decent rise.| | Liquid Staking |-2.1% | LBR,AGI,LAY3R | This sector experienced a slight decline this week, with the leading rising cryptocurrencies maintaining their growth within a small range, and the distribution continues to remain relatively balanced.| | AI | 2.9% | TSAI,FLARE,39A | The AI sector has seen some recovery this week, but the increase in top coins is concentrated in a few specific coins, while the overall increase in other coins in the sector is relatively small.|

Author: Charles T., Gate.io researcher *This article only represents the author's views and does not constitute any trading advice. Investment carries risks, and decisions should be made cautiously. *The content of this article is original and copyright belongs to Gate.io. If reprinted, please indicate the author and source, otherwise legal responsibility will be pursued.