Bitcoin vs Emas: Pertarungan Tempat Perlindungan

Selama berabad-abad, emas telah menjadi aset tempat perlindungan terbaik dan penyimpan nilai. Dalam beberapa tahun terakhir,Bitcoin- mata uang kripto pertama dan terbesar - telah muncul sebagai saingan digital, sering disebut sebagai “emas digital.” Kedua aset ini memiliki para pendukung yang antusias: emas karena stabilitas nyata, Bitcoin karena potensi teknologi tinggi dan pertumbuhan tinggi. Dalam blog ini, kami mengambil pandangan jurnalistik tentang Bitcoin vs Emas, membandingkan peran mereka sebagai penyimpan nilai, kinerja historis, volatilitas, kelebihan sebagai lindung nilai inflasi, dan apa yang mungkin terjadi di masa depan untuk dua aset yang sangat berbeda ini.

Bitcoin dan Emas sebagai Penyimpan Nilai

Penyimpan nilai merujuk pada aset yang dapat mempertahankan (atau meningkatkan) nilainya dari waktu ke waktu. Reputasi emas sebagai penyimpan nilai dibangun dari ribuan tahun sejarah manusia - sangat langka, tahan lama, dan diakui secara universal. Bitcoin, diluncurkan pada tahun 2009, adalah yang baru yang dengan cepat mendapatkan pengikut sebagai penyimpan nilai digital karena kelangkaan yang diprogram dan sifat terdesentralisasi. Inilah bagaimana kedua hal tersebut dibandingkan dalam atribut kunci:

- Sejarah & Kepercayaan: Emas telah digunakan sebagai simpanan kekayaan selama berabad-abad (dari koin kuno hingga modern cadangan bank sentral), memperoleh kepercayaan yang tak tertandingi dari waktu ke waktu. Bitcoin, sebaliknya, hanya memiliki sejarah selama lebih dari satu dekade. Meskipun tidak memiliki catatan panjang, Bitcoin dengan cepat mendapatkan kepercayaan di kalangan investor yang menguasai teknologi dan beberapa institusi selama rentang hidup singkatnya.

- Kelangkaan: Pasokan emas tumbuh secara perlahan (sekitar 1-2% per tahun melalui penambangan), dan ada jumlah terbatas di kerak bumi. Bitcoin bahkan lebih ketat terbatas - pasokannya dibatasi hingga 21 juta koin, dengan bitcoin baru dirilis dalam jadwal yang dapat diprediksi yang berkurang sekitar setiap empat tahun sekali (peristiwa yang dikenal sebagai "halving"). Kedua aset ini tidak dapat diciptakan sewenang-wenang, berbeda jauh dengan mata uang fiat yang dapat dicetak dalam jumlah tak terbatas.

- Nyata vs Digital: Emas bersifat fisik dan berwujud – Anda dapat memegang emas batangan atau koin di tangan Anda. Fisik ini berarti membutuhkan penyimpanan yang aman dan bisa mahal untuk diangkut. Bitcoin hanya ada secara digital di jaringan komputer global (rantai blokIni tidak memiliki bentuk fisik, yang membuatnya mudah dibawa (Anda dapat mengirim nilai di seluruh dunia secara online) tetapi juga berarti bergantung pada internet dan listrik untuk mengaksesnya.

- Pembagian & Kebermanfaatan: Bitcoin sangat mudah dibagi (Anda dapat menghabiskan sebagian kecil koin) dan mudah ditransaksikan, yang menambah kegunaannya sebagai toko nilai modern atau bahkan sebagai medium pertukaran. Emas kurang mudah dibagi dalam hal praktis (mencukur gram dari batang tidak nyaman) dan tidak digunakan langsung dalam transaksi sehari-hari. Namun, emas memiliki kegunaan praktis - dari perhiasan hingga elektronik - yang memberikan permintaan dasar di luar investasi. Nilai Bitcoin didorong secara murni oleh permintaan investor dan penggunaan jaringannya, karena tidak memiliki kegunaan industri.

- Adopsi Pasar: Emas banyak dimiliki oleh individu, lembaga, dan bahkan pemerintah. Bank sentral secara kolektif memegang puluhan ribu ton emas sebagai bagian dari cadangan mereka, menekankan penerimaan institusional emas. Bitcoin berada dalam tahap awal adopsi - belum ada bank sentral yang memegang Bitcoin (belum), tetapi semakin banyak investor ritel, perusahaan, dan bahkan beberapa negara yang memegangnya sebagai alat pembayaran yang sah. Tren adopsinya kuat tetapi juga menghadapi pengawasan regulasi di banyak negara, yang sebagian besar dihindari emas pada saat ini.

Singkatnya, emas menawarkan keamanan tradisi dan kejelasan, sementara Bitcoin menawarkan inovasi dan potensi keuntungan tinggi sebagai simpanan nilai era digital. Selanjutnya, mari kita lihat bagaimana mereka sebenarnya performa untuk para investor.

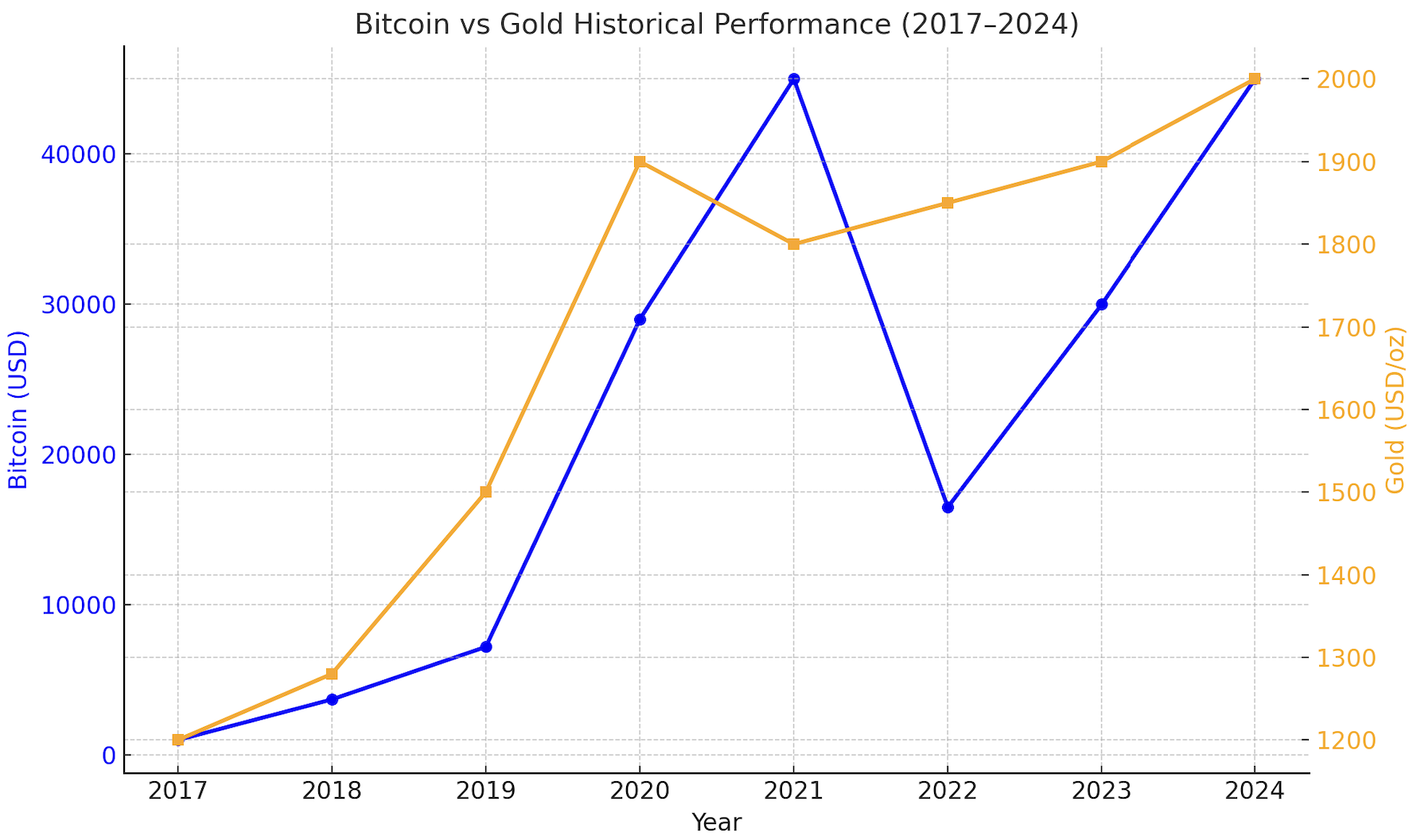

Kinerja Harga Historis

Ketika membahas tentang kinerja harga, perbedaan antara emas dan Bitcoin telah dramatis. Emas dikenal karena stabilitasnya dalam jangka panjang - umumnya menjaga kekayaan dan melampaui inflasi dengan sedikit, tetapi tidak dikenal karena lonjakan harga yang besar dalam periode singkat. Bitcoin, di sisi lain, telah memberikan keuntungan yang mengagumkan sejak awalnya, namun dengan volatilitas yang ekstrem.

Selama dekade terakhir, Bitcoin telah menjadi kelas aset dengan kinerja terbaik di dunia. Pada awalnya, satu bitcoin hampir tidak berharga - hanya beberapa sen. Pada tahun 2011 nilainya hanya beberapa dolar, dan satu dekade kemudian nilainya melonjak menjadi puluhan ribu dolar per koin. Sebagai contoh, lima tahun yang lalu (sekitar 2016-2017), Bitcoin diperdagangkan di bawah $1.000; saat ini sering berfluktuasi di $30,000–$50,000 rangeper koin. Itu adalah kenaikan ribuan persen. Pertumbuhan Bitcoin tidak stabil atau lancar, namun mengalami beberapa siklus booming dan bust (lebih lanjut mengenai volatilitas nanti). Lonjakan besar pada tahun 2013, 2017, dan 2020–2021 menyebabkan harga berkali-kali lipat dengan cepat, sementara pasar beruang yang menyusul menyebabkan penurunan 50% atau lebih. Investor awal yang bertahan melalui gejolak telah melihat keuntungan yang luar biasa: bahkan dengan adanya penarikan, tren jangka panjang Bitcoin telah mengalami peningkatan tajam.

Kinerja harga emas jauh lebih mantap dan sederhanaSebuah dekade yang lalu, pada tahun 2013, emas berada di sekitar $1,300 per ons. Pada tahun 2025, emas kira-kira di $1,900–$2,000 per onsselama lebih dari sepuluh tahun, itu adalah keuntungan yang layak (sekitar 50% lebih tinggi dalam mata uang USD, tanpa memperhitungkan inflasi). Emas mencapai rekor tertinggi sekitar $2,070 pada tahun 2020 di tengah ketidakpastian pandemi dan kembali mendekati level rekor selama periode inflasi tinggi pada tahun 2022–2023. Namun secara keseluruhan, grafik harga emas terlihat relatif datar dibandingkan dengan lonjakan harga Bitcoin. Pemegang emas jangka panjang telah melihat kekayaan mereka terjaga dan berkembang secara perlahan – misalnya, dalam 20 tahun terakhir emas sekitar empat kali lipat dari awal tahun 2000-an hingga sekarang – namun mereka tidak mengalami sesuatu seperti hasil yang meledak dari Bitcoin.

Salah satu perbedaan kunci antara Bitcoin dan emas jelas terilustrasi oleh sejarah harganya. Selama dekade terakhir, harga Bitcoin melonjak dari di bawah $100 pada tahun 2013 menjadi hampir $70,000 pada puncaknya tahun 2021, dan tetap berada di puluhan ribu pada tahun 2025. Sebaliknya, harga emas naik perlahan dari sekitar $1,300 per ons menjadi sekitar $1,900 per ons selama periode yang sama. Grafik di atas (menggunakan skala logaritmik karena kenaikan besar Bitcoin) menyoroti pertumbuhan eksponensial Bitcoin - jauh melampaui kenaikan kumulatif emas - tetapi juga menunjukkan fluktuasi tajam Bitcoin, dalam kontras tajam dengan garis yang relatif stabil emas. Dengan kata lain, Bitcoin akan jauh melipatgandakan investasi yang dibuat sepuluh tahun lalu, sedangkan emas akan memberikan kenaikan yang stabil dan moderat.

Perlu dicatat bahwa emas telah menunjukkan nilainya selama abadSebuah contoh yang sering dikutip: satu ons emas bisa membeli setelan pria yang bagus seratus tahun yang lalu, dan masih bisa sampai sekarang - sebuah bukti dari keberlanjutan daya beli emas dalam jangka panjang. Bitcoin tidak memiliki berabad-abad sejarah, tetapi para pendukungnya berpendapat bahwa jika itu telah ada selama rentang waktu yang sama, pasokan yang terbatas secara matematis akan dengan demikian mempertahankan nilai dalam jangka panjang (dan bahkan sangat menghargai saat adopsi berkembang).Secara historis, harga emas cenderung naik selama masa krisis ekonomi atau inflasi, sementara kinerja historis Bitcoin lebih terkait dengan kurva adopsi teknologi dan likuiditas di pasar keuangan.

Perbandingan Volatilitas

Volatilitas adalah di mana Bitcoin dan emas secara dramatis berbeda. Emas dihargai sebagian karena merupakan simpanan nilai yang relatif stabil. Pergerakan harganya biasanya cenderung lambat. Di sisi lain, Bitcoin dikenal sebagai aset yang sangat volatile.

- Pada hari-hari biasa, harga emas mungkin bergerak 1% atau kurang – lonjakan $20 pada ons $2,000 akan menjadi hal yang biasa. Lonjakan emas yang signifikan sebesar 5–10% dalam sehari sangat jarang terjadi dan biasanya terkait dengan peristiwa geopolitik atau ekonomi utama.

- Bitcoin, pada hari-hari tertentu, dapat dengan mudah naik atau turun 5% (terkadang jauh lebih besar). Pergerakan persentase dua digit dalam sehari pernah terjadi selama krisis atau kondisi pasar yang panik. Sebagai contoh, pada Maret 2020, ketika kepanikan COVID-19 melanda pasar, harga Bitcoin anjlok sekitar 50% dalam waktu beberapa hari - pergerakan ekstrem yang hampir tidak terbayangkan bagi emas dalam waktu yang begitu singkat. Selama lonjakan bullish 2021, Bitcoin sering kali melonjak atau turun ribuan dolar dalam hitungan jam karena kegilaan spekulatif.

Selama periode yang lebih lama, volatilitas emas rendah. Investor melihat emas sebagai aset yang aman dan stabil yang mungkin sedikit turun atau naik dengan persentase moderat setiap tahun. Bitcoin, sebaliknya, telah melihat pergerakan tahun ke tahun yang luar biasa: dapat melipatgandakan nilainya dalam setahun, atau kehilangan lebih dari 70% dari nilainya dalam penurunan yang parah. Volatilitas tinggi ini berarti risiko lebih tinggi: seorang investor di Bitcoin harus tahan gejolak nilai portofolio yang parah, sedangkan pemegang emas biasanya melihat fluktuasi kekayaan yang jauh lebih sedikit.

Mengapa Bitcoin begitu lebih fluktuatif? Beberapa alasan: Bitcoin masih merupakan kelas aset yang relatif muda dan baru muncul, dan nilainya didorong oleh spekulasi dan narasi yang berubah. Pasarnya lebih kecil dan kurang likuid dibandingkan dengan emas, sehingga uang yang masuk atau keluar memiliki dampak yang lebih besar pada harga. Berita regulasi, peretasan, atau perubahan sentimen investor dapat memicu respons yang berlebihan. Di sisi lain, pasar emas sudah sangat mapan – lebih sulit untuk mengguncang pasar yang sudah ada selama berabad-abad dengan jutaan peserta dan basis industri yang luas. Emas juga memiliki semacam nilai dasar dalam penggunaannya dancadangan bank sentral, yang meredam spekulasi liar. Bitcoin masih mencari penemuan harga sejatinya di tengah pertumbuhan dan adopsi yang cepat.

Dengan demikian, volatilitas Bitcoin sedikit menurun seiring bertambahnya usia - fluktuasi liar pada awal tahunnya (ketika harganya bisa melonjak 1000% dan turun 80% secara rutin) agak mereda seiring pertumbuhan pasar. Namun, dibandingkan dengan aset tradisional (saham, obligasi, dan bahkan emas), Bitcoin tetap sangat volatil. Peran emas sebagai pengstabil dalam portofolio (seringkali bergerak berlawanan dengan aset berisiko dalam krisis) cukup berbeda dari profil Bitcoin sebagai aset berisiko tinggi, berpotensi tinggi yang sering diperdagangkan lebih seperti saham teknologi atau investasi beta tinggi.

Investor yang mempertimbangkan Bitcoin vs emas harus menimbang perbedaan volatilitas ini: emas menawarkan ketenangan pikiran dengan volatilitas yang relatif rendah, sedangkan Bitcoin menawarkan peluang untuk pengembalian tinggi namun dengan aksi harga roller-coaster.