XRP Price Prediction: XRP Pulls Back Near 20%, Bull Accumulation May Prepare the Way for $10–$15 Return?

XRP Poised for a New Rally After Short-Term Pressure Release

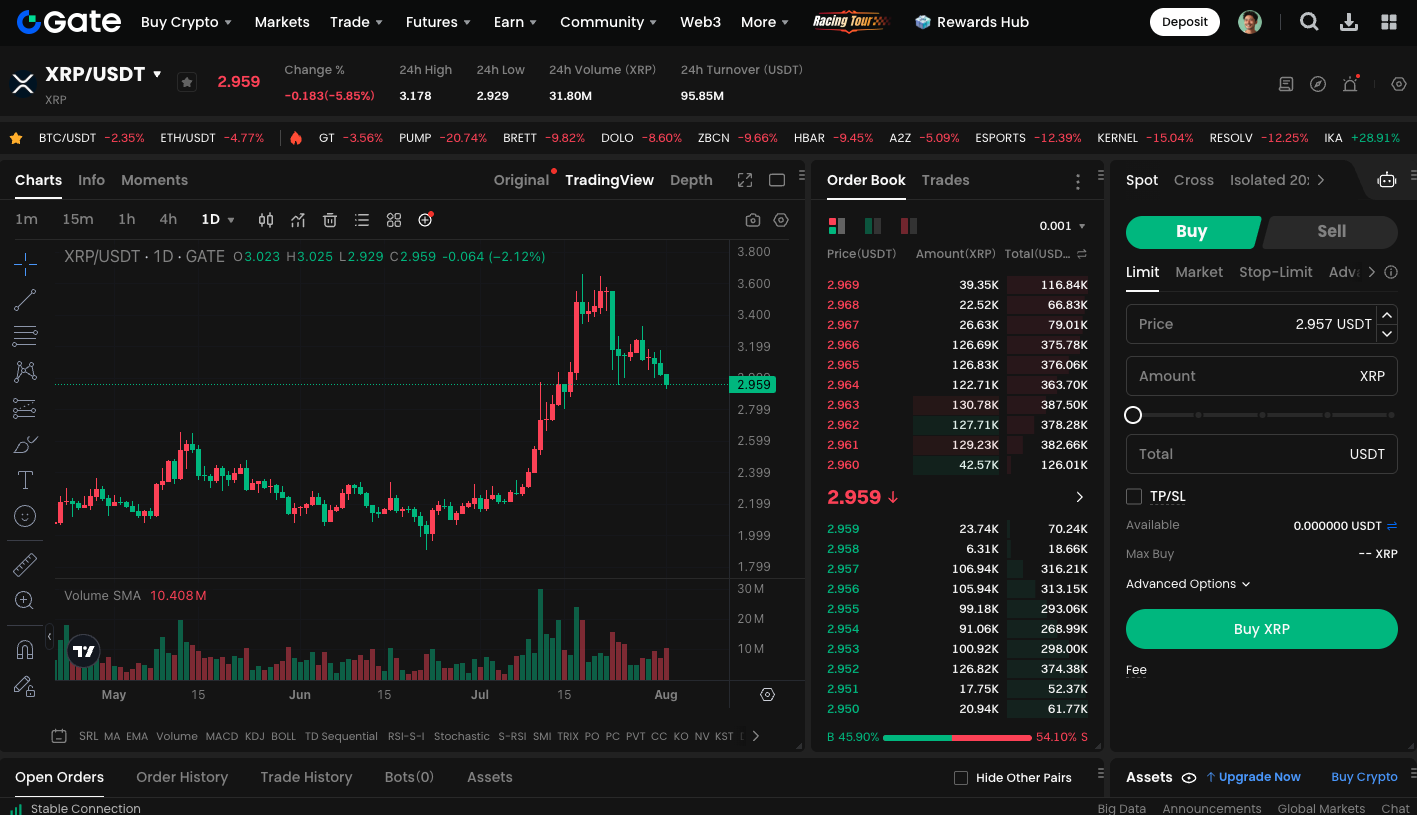

Following a powerful surge that propelled XRP to multi-year highs, the token has recently undergone a steep correction. Its price retreated nearly 20% from $3.66 and is now trading around $2.95. Despite the rapid pullback, analysts widely view this as a healthy, typical correction that helps build momentum for the next upward leg.

RSI Decline Alleviates Pressure

From a technical standpoint, XRP’s relative strength index (RSI) spiked to 88 last week, signaling extremely overbought conditions. The daily RSI has since dropped to a neutral 50, indicating the overextension has effectively eased. If XRP holds the $3 level and retains support from the 100-period moving average, it could complete a short-term bottom and set the stage for another move higher.

If this support zone fails, the next key level is near $2.6—the 200-period moving average—which may serve as a potential retracement area and attract medium- and long-term investors looking to buy on weakness.

Analyst Perspectives

Multiple crypto analysts remain composed amid the recent decline:

- Egrag Crypto notes that while the short-term breakdown came with heavy selling pressure and high volume, robust buy-side demand quickly emerged, signaling that bulls have not abandoned the field.

- XRPunkie further argues that the current correction reflects the market’s healthy rhythm, and maintains that XRP still has a shot at reaching the $10–$15 range in the mid-term.

- Dom adds that if market structure remains steady, XRP’s ultimate high could land between $7 and $10.

Long-Term Outlook for XRP Remains Strong

Bitpanda Deputy CEO Lukas Enzersdorfer-Konrad observes that despite heightened volatility, XRP continues to demonstrate strengths in liquidity and institutional participation. He believes XRP is capable of surpassing its 2018 record high, especially if overall confidence returns to the crypto market.

Start trading XRP spot now: https://www.gate.com/trade/XRP_USDT

Summary

XRP’s ability to hold above $2.95 remains a key focus, with attention centered on the critical $3 technical and psychological threshold. Should a solid bottom form and a new upward trend emerge, the previously projected $10–$15 target range remains achievable. Investors should exercise patience, closely watch trading volumes and support responses, and avoid letting short-term price swings cause them to miss out on medium- to long-term potential.