BIO launches V2. Can the new Launchpad spark a resurgence in the DeSci trend?

As the leading project at the intersection of scientific research and crypto, $BIO—regarded as a trailblazer in the DeSci sector—has faced persistent headwinds since its January launch. Despite backing from industry titans like Vitalik Buterin and CZ, $BIO couldn’t escape the twin pressures of market downturns and liquidity crunches. Its market cap plunged by as much as 95% from its opening high, becoming the focal point of criticism and doubt within the community, while also dragging the entire sector—home to previous giants like $RIF and $URO—into a prolonged slump.

Yet, with the recent rollout of BIO Protocol V2, introducing innovations like Launchpad and staking points, total staked BIO crossed 100 million within the first week. The market cap surged, doubling to over $200 million, once again igniting investor enthusiasm and market imagination for what's possible in DeSci.

Why Did $BIO Crash Despite Its Star-Studded Backing?

BIO’s launch was initially the high point for DeSci: major exchanges like Binance, OKX, and Kraken listed the token, its TGE saw trading volumes exceed $2 billion, and FDV soared to $250 million, making it the most talked-about scientific crypto asset launch in early 2025. But beneath the surface, the seeds for the price crash had already been sown.

The market euphoria faded quickly. BIO’s auction-based release meant a higher initial circulating supply than most new tokens. Combined with a lofty debut valuation and absent immediate utility, price reality lagged far behind the hype. Early demand was fueled more by storytelling than substance, and with core features like Launchpad, staking, and BioXP Points still in development, investors soon realized their tokens brought neither short-term returns nor governance rights. The mismatch between valuation and real-world application led to the first sharp price drop.

Timing issues made matters worse. Key features failed to launch alongside the TGE, eroding confidence during the waiting period. The decision to operate Launchpad independently through Molecule Catalyst split both attention and capital, weakening the main platform’s cohesion. Meanwhile, a risk-off turn in macro markets hastened the exodus of funds from high-FDV, no-cash-flow projects. With little in the way of fresh news and no product launches to maintain momentum, BIO went from a star performer at the year’s start to a thinly traded asset searching for a bottom.

BIO Protocol’s Comeback

Building a Fast-Track Research Laboratory

In the first half of 2025, BIO Protocol’s trajectory was anything but smooth—sliding from narrative peak to price nadir—yet its momentum never waned. The project delivered top-tier performance in the DeSci sector, and even managed to push several biopharma candidates to the brink of clinical trials, providing “on-chain science” with its first real-world medical validation.

The price drawdown didn’t dampen the team’s ambition. Instead, it sparked a renewed wave of development. In May, BIO used blockchain-based governance to postpone token vesting for team members and advisors—signaling long-term commitment to the market. Scientific milestones stood out too: VitaRNA and VitaFAST both began clinical trials in the UAE, moving from concept to enrollment in just 11 months (versus the traditional 4–6 years); 14 AI-predicted compounds with forecasted success rates above 85% await Q3 results. Meanwhile, five new BioDAOs—QBIO, Long Covid Labs, Curetopia, SpineDAO, and MycoDAO—have launched, raising a cumulative $8.9 million this year, accelerating research progress.

V2: Advancing from DeSci 1.0 to DeSci 2.0

In August, the BIO team officially rolled out Bio Protocol V2. Their aim: to shift research financing and execution into high gear, while solving DeSci 1.0’s pain points—high FDV launches, lack of immediate utility, and ecosystem fragmentation.

V2’s foundation rests on four core engines:

Low-FDV, Fixed-Price Launch: Following the playbook of Pump.fun and Virtuals, V2 debuts projects at an initial FDV of just $205,000, with 35% of tokens sold directly and all raised $BIO injected into the liquidity pool. This ensures deep liquidity and price momentum from day one, tightly aligning community and project interests.

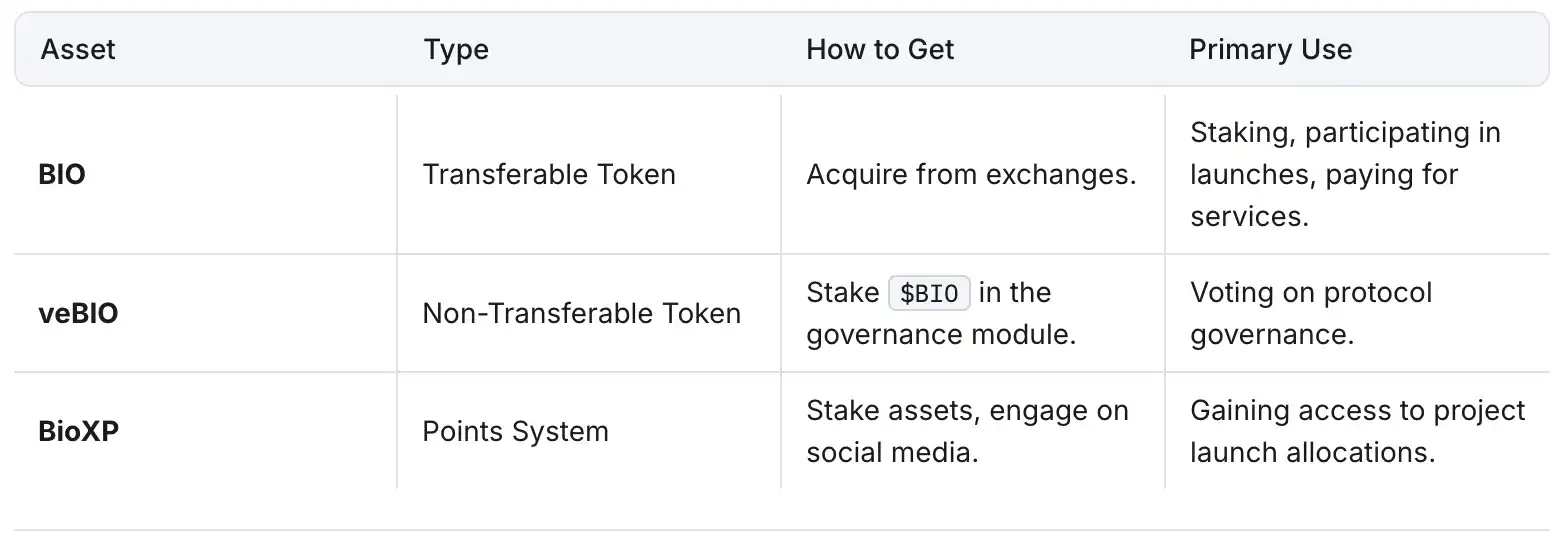

BioXP Points System: Actions like staking, liquidity provision, on-chain activity, and social sharing are converted into points, which link to a DeSci Score. Points remain valid for 14 days and unlock preferential allocations for low-FDV projects—highly engaged users continually receive priority access.

Staking & veBIO: Staking $BIO boosts point earnings and grants governance voting rights, while staking other ecosystem assets offers even higher point yields, incentivizing broad network support.

Liquidity Engine: At launch, an LP is created automatically. Each secondary market trade incurs a 1% fee—70% to the project treasury, 30% to the protocol—creating a virtuous cycle of “active trading → more research funding → faster results → renewed market excitement.”

Accelerating Deployment: Ushering in a New DeSci Cycle

VitaRNA and VitaFAST are turning DeSci from a bold vision into real-world results. Both therapies will be tested simultaneously in the UAE, Singapore, and Switzerland, and are expected to become the first DeSci-funded drugs to reach clinical trials in under two years and at a cost below $500,000. This will shatter the traditional norms of years-long, multimillion-dollar drug development and set a new standard for blockchain-powered research. At the same time, BIO is collaborating with Pfizer on a pilot to explore compliant IP tokenization (IPT), aiming to build new capital circulation and value-sharing models for future pharmaceutical R&D.

Bio Protocol is launching decentralized agents to automate critical scientific workflows like drug screening, clinical operations, and financial management. The soon-to-be-launched BIO Copilot will become an on-chain research assistant, helping scientists push research into a programmable, scalable, AI-powered realm—shifting science out of labor-constrained bottlenecks and into rapid, intelligent iteration.

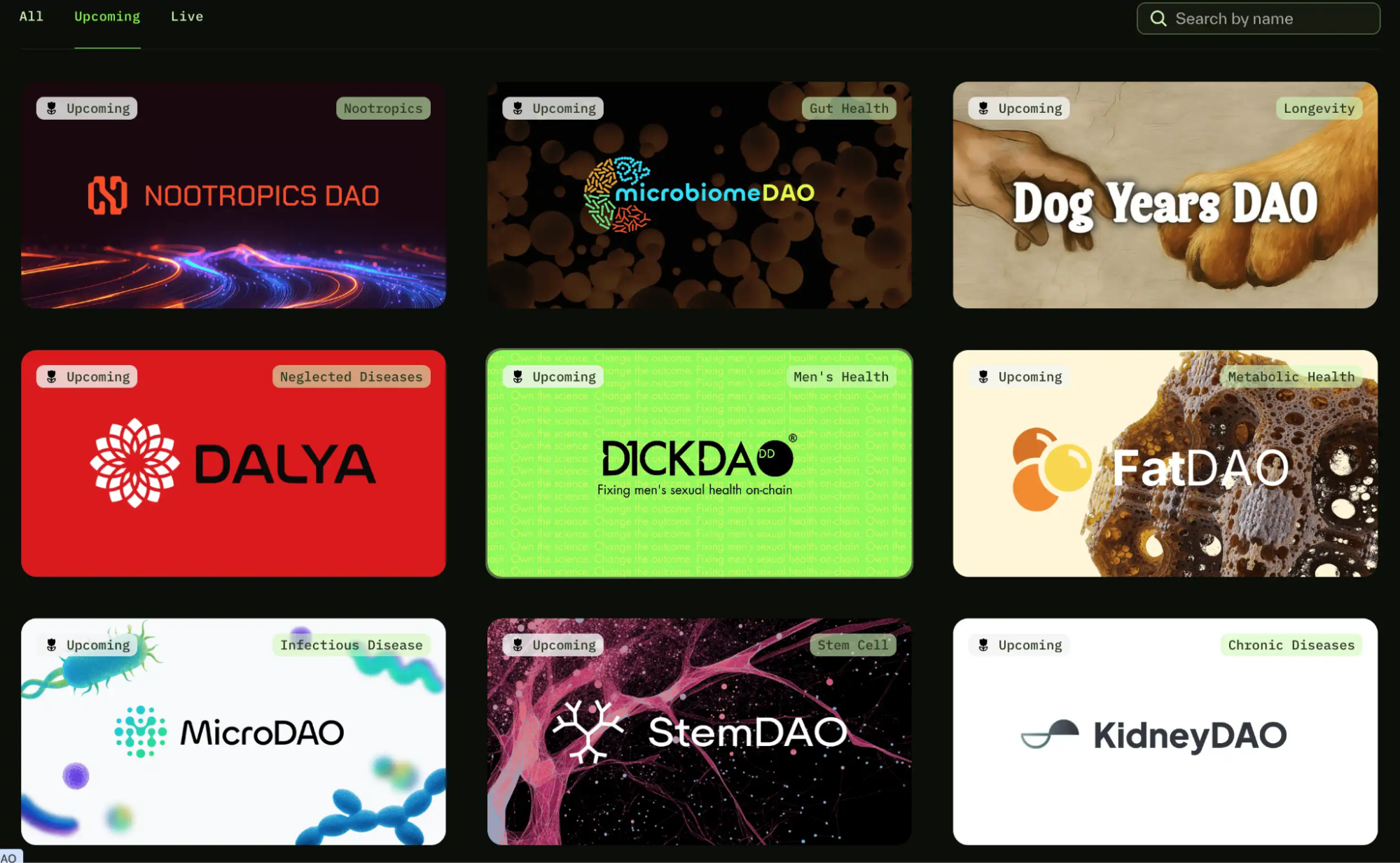

Meanwhile, capital and market momentum is quietly building. Launchpad 2.0 is set to roll out 10–20 low-cap projects covering agents, IPT, research tools, and more in the coming months, with an average raise of $70,000. The Base chain will launch first, followed by Solana. Meanwhile, the “Founding LP Program” is attracting liquidity providers willing to commit $100,000+ in BIO LP. These participants are rewarded with higher yields, bonus points, priority allocations, and exclusive support. By drawing on successful models such as Virtuals’ high-yield launches, BIO aims to energize a new market upcycle, creating a closed loop of research capital, tokens, and information to accelerate progress toward the “Scientific Singularity.”

What Is DeSci? The Decentralized Engine Accelerating Scientific Innovation

If traditional science is a lumbering steam engine, decentralized science (DeSci) is a high-speed electric motor—lighter, faster, and radically transparent.

Historically, research funding was controlled by government agencies, academic institutions, and pharmaceutical giants. Just securing approval for funding could take months or years, and finished work was locked behind pricey paywalls—even taxpayer-funded projects were inaccessible to the public. Data storage, IP ownership, and commercialization were tightly policed by centralized institutions. While this system was stable, it came at the cost of efficiency and frequently discouraged breakthrough innovation.

DeSci is out to disrupt this slow, top-down ecosystem. By leveraging blockchain’s open ledgers, DeSci brings full transparency to funding, progress, and data usage. DAOs replace small review panels, enabling broad community votes to determine research direction. Token incentives bind early backers’ interests to project outcome, attracting capital and talent. This approach shortens funding cycles and enables global, cross-disciplinary collaboration, empowering innovative ideas that once struggled to secure support.

BIO Protocol is a standout, ambitious force in this space. It doesn’t just provide early-stage funding for biotech projects—it assembles a full stack of infrastructure for project vetting, fundraising, on-chain liquidity, data transparency, and research automation. With BIO, scientists can crowdsource funding globally, just as crypto startups do, while investors can participate from the outset and share in eventual commercialization. BIO’s vision is an ecosystem where grants aren’t bottlenecked by approvals, monopolies are broken, and everyone has a pathway to participate and benefit.

Conclusion

BIO Protocol has gone from early-year highs to a brutal midyear crash and has now staged a meaningful rebound with V2. Innovations like low-FDV launches, points-based staking, and new liquidity mechanisms have reenergized the ecosystem, reigniting market interest in DeSci. Whether this rebound will continue and produce steady new token returns depends on project execution and broader market conditions. Near-term uncertainty still lingers.

Disclaimer:

- This article is republished from [BlockBeats] with copyright belonging to the original author [kkk]. If you have any concerns about this republication, please contact the Gate Learn team, and we will address your request promptly according to our procedures.

- Disclaimer: The opinions expressed herein are those of the author alone and do not constitute investment advice of any kind.

- Other language versions of this article are translated by the Gate Learn team. Without explicit reference to Gate, translated content must not be copied, reproduced, or plagiarized.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge